The increasing focus on delivering good outcomes for retail customers has been at the forefront of the Financial Conduct Authority (FCA)’s Consumer Duty legislation. The FCA has not shied away from its goal of empowering customers with better information to evaluate the pros and cons before making a purchase. This has put the long-standing plan to regulate Buy Now Pay Later (BNPL) products under the spotlight.

As BNPL products gain popularity, they also attract more scrutiny from regulators. While the new regulation is currently under consultation, the FCA aims to ensure that all credit providers, including BNPL providers, adhere to existing rules. More importantly, the FCA is championing the cause of ensuring customers are well-informed about the facts and figures before committing to any credit product.

For businesses offering BNPL options, it is crucial to stay ahead of the curve and adapt to these changes to remain compliant and maintain consumer trust.

Younger customers lean on BNPL more

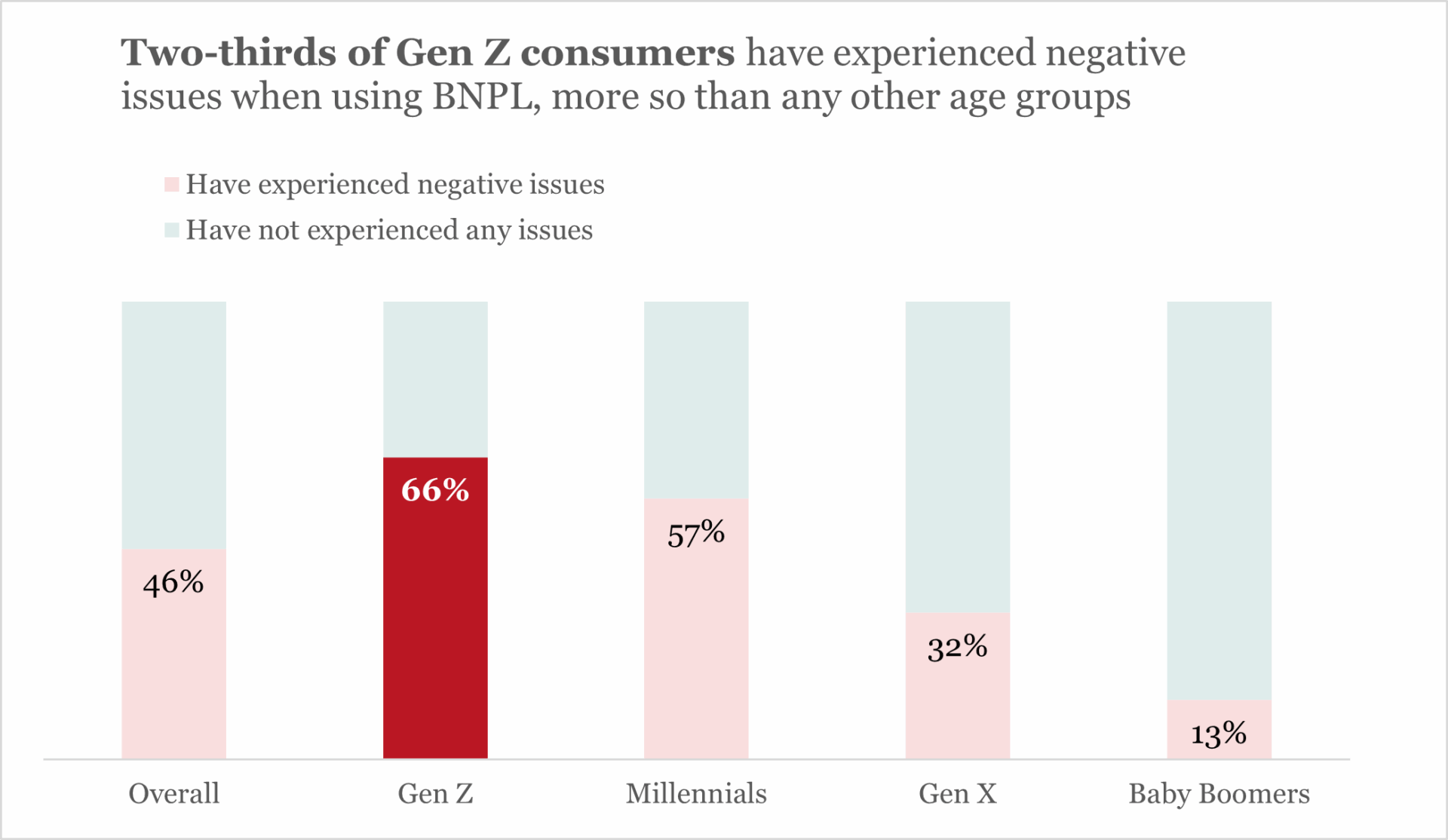

Data gathered from Savanta Consumer Omnibus in November 2024 shows that more people are turning to BNPL options than ever before. This trend is particularly prominent among younger generations, with Gen Z (55 %) and Millennials (63%) leading the charge. However, it appears customers’ experiences have not been smooth sailing. 66% of Gen Z consumers who have used BNPL have experienced negative issues, +20 percentage-points more than the overall sample.

Focusing on the Gen Z cohort, their negative experiences often revolve around the clarity of information provided to them. 1 in 5 Gen Z users found it difficult to keep track of payments (20%), followed by confusion over whether missing a payment would impact their credit score (18%) and concerns about additional interest fees when they missed a payment (17%).

Clearly, this is the pain point the FCA aims to address. BNPL products are not currently being regulated like other credit lending options, leading to customers misunderstanding terms and conditions and potentially falling behind on payments. This could have a massive impact on users’ financial situations and requires addressing.

In this context, we found that only 41% of Gen Z claim they have a good understanding of the repayment terms before using BNPL, the lowest among all age groups. Comparing the results to the Savanta Consumer Omnibus data in November 2023, the number of customers being charged late payment fees has risen from 25% to 30% in 2024. Once again, Gen Z (44%) is the most vulnerable, followed by Millennials (40%).

These statistics underscore the current vulnerabilities within the BNPL space, especially for younger customers. Businesses must be more transparent and clearly communicate the terms and conditions of their BNPL offerings, particularly with the expected scrutiny from the FCA.

Handing you the map to the BNPL maze

Ensuring your BNPL offers are clear, transparent, and compliant with legislation is crucial. At Savanta, we specialise in conducting communication testing, from benchmarking KPIs against the market to comprehensive communication strategy diagnostics, to help your company deliver effective messages to your customers.

We’ve successfully assisted businesses in adapting to regulatory changes before, such as with the Consumer Duty, and we can do the same for you. Our unique approach involves scoring against market KPIs through online surveys, helping you discover the key messages your customers take away and allowing you to act upon this knowledge. Our clients have benefited by understanding which parts of their communication have the highest clarity and identifying areas where further optimisation is needed.

Test Now, Act Now

As the BNPL landscape continues to evolve, reviewing and perfecting your communication strategy ahead of upcoming regulatory changes is more important than ever. We can help you identify the information that drives your customers to use your products and leverage it to strengthen the trust between you and them.

Contact our business experts here to stay ahead of legislative change.

Now is better than later.