Only 38% of consumers consider ethical / sustainable investment opportunities when choosing their financial provider.

Sustainable finance is not top of mind for consumers. In fact, it’s bottom of their list, with only 38% considering ethical / sustainable investment opportunities when choosing their financial provider.

Instead, customer service (59%), online banking (58%), interest rates (52%) and getting the highest returns (46%) are top priorities. And given the current economic turmoil, it’s understandable that consumers are looking for a safe pair of hands.

Yet our Sustainability Segmentation (which reveals how intentions and actions towards sustainability vary across the finance sector), identified that there is demand for banks to take tentative steps towards sustainable investments.

About our Sustainability Segmentation

Our study uncovers how society is embracing – or resisting – a desire to meet sustainable goals, even during a deep and global economic crisis, setting out to help marketers effectively communicate, and market, sustainability in a manner that directly connects with customer values.

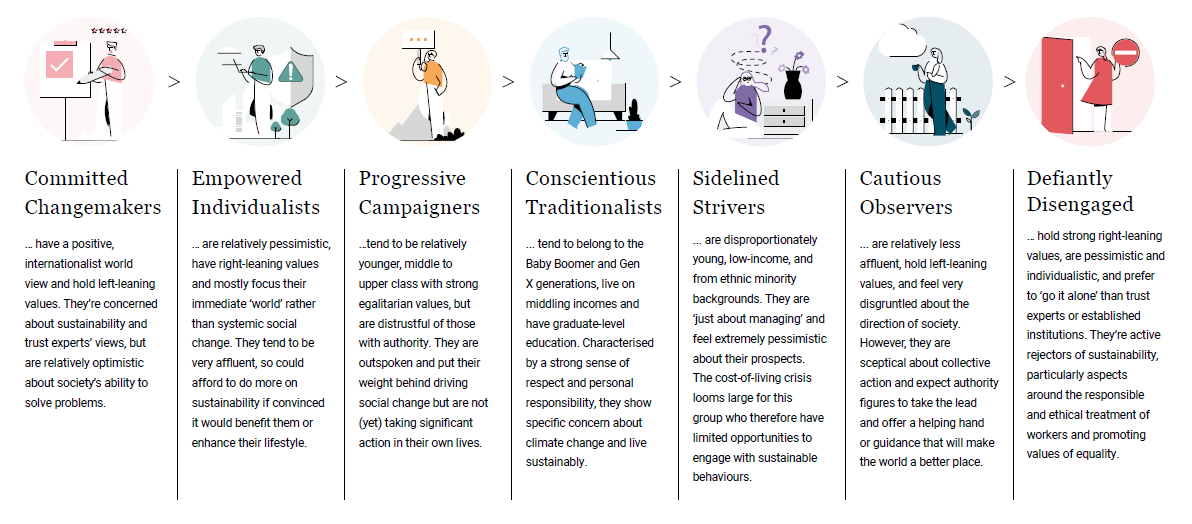

Our findings identified that the public falls into seven segments based on their awareness, knowledge, ability to care and behaviours; from Committed Changemakers who have a positive, internationalist world view and hold left-leaning values to the Defiantly Disengaged, those holding strong right-leaning values, who are pessimistic and individualistic and prefer to ‘go it alone’ than trust experts or established institutions.

Download our free report here to read more about your audience segments.

How important is ethical / sustainable banking?

Around half of Committed Changemakers (56%), Empowered Individualists (54%), and Progressive Campaigners (47%) rate sustainability as an important consideration when choosing who to bank with – and this is on par with getting the best returns.

Additionally, half (51%) of Conscientious Traditionalists rate sustainability as important, but highest returns (60%) ultimately take precedence for this segment.

So why is this factor not higher on their list of considerations when it comes to decision-making?

Risk or return?

Banks need to tell a convincing story that sustainable investments can balance risk and return, and that not investing in sustainable funds may be a risk in itself over the long-term.

With the drive towards net zero in mind, consumers who invest in sustainable banking now stand to benefit in the future.

Download our infographic to view the full list of consideration factors by segment.

Education is key

Whilst many are thinking ahead when it comes to banking and investment, our study identified a lack of public awareness around where their money goes.

This gap in knowledge, coupled with the fact that many consumers are calling out to be involved in deciding where their money is invested, has highlighted the opportunity for financial providers to deliver greater education around sustainable finance. And considering a third of Empowered Individualists (34%) and Committed Changemakers (30%) regularly change banks, there’s everything to play for.

So what?

- Improving awareness: Educate customers and improve awareness on sustainability by actively promoting consumer-friendly informational content.

- Facilitating switching: Make it easy for sustainability-conscious customers to switch, by giving them greater involvement in decisions around responsible, ethical-first investing.

- Maximise engagement: Digital platforms need to be optimised to engage and educate consumers on how to invest in line with their values.

Download our infographic to read more around what this means for your business or access the full report via the below form.

Notes:

The report is based on the findings of a survey of 12,016 adults aged 18+ in the United Kingdom (5,005), United States (5,006) and Canada (2,005). Data are weighted to be representative of age, gender, region and social grade (UK) or income/education (US and Canada).

Our segments include:

Download the full report: