Knowing a population’s motivations and needs will help councils put forward the most effective proposals.

Councils are continuing to explore how to achieve these goals, and at first glance it may seem this ambition is shared by the public: in a recent survey we found only 10% of the population are not concerned about climate change.

However, the results can be a little less clear when you take the issue away from an abstract ‘concern’ and examine individual choices. As an example, when deciding on how to make a journey, only 24% of participants consider the carbon emissions generated, which is apparently far less important than how far they have to travel and how much transport costs (both 54%).

This seems to stem from a partial disconnect between how concerned people feel about the climate and how empowered they feel to enact change, particularly in relation to transport. However, it’s important not to treat people as a single homogenous group, but rather to acknowledge the particular motives and barriers for people in moving towards more sustainable travel.

Our segments

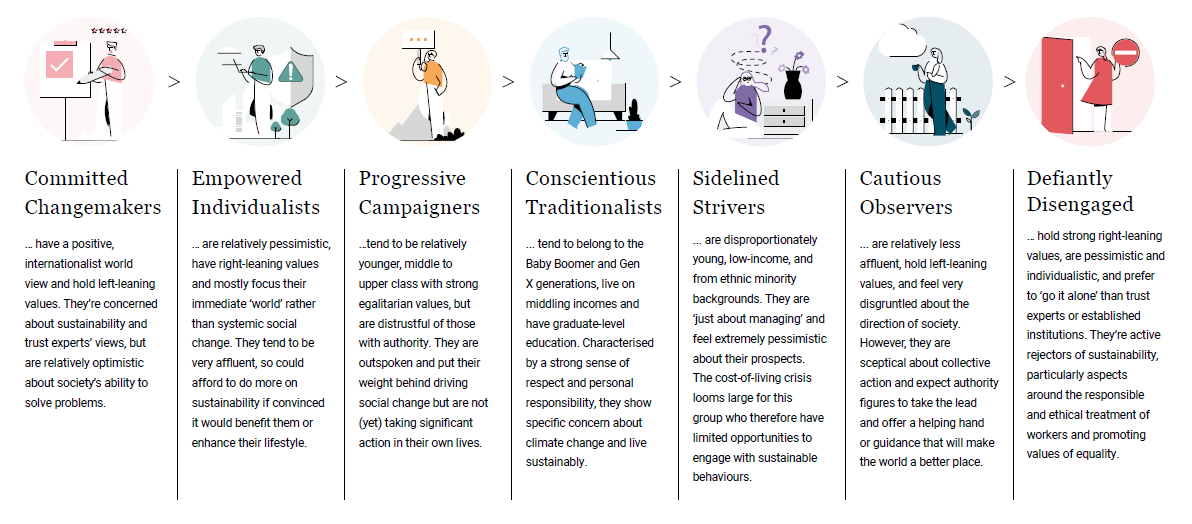

Our research has identified seven cohorts of people with different traits and views on environmental sustainability:

Understanding the human factor

We have built these profiles by exploring the underlying motivations of behaviour and how people think and act using the COM-B model. This model builds on how behaviour can be changed by understanding the different human factors at play, namely:

- (C)apability – Do people have the ability to make that change? Eg access to safe walking routes or accessible routes

- (O)pportunity – Do people have the chance to make that change? Eg a reason to walk, somewhere in reasonable walking distance they have a reason to go to

- (M)otivation – Do people want to make that change? Eg a desire to improve their fitness or save money on car journeys.

Each of these factors is weighed up and feed into the (B)ehaviour change.

Obviously for councils, the human factor has to be considered against other issues such as current infrastructure, the potential cost of solutions, how many people it would serve and how effective the solution is at addressing climate change.

This all needs to be weighed and aligned with the capability, opportunity and motivations of a population to successfully nudge people towards more sustainable transport options. Thus, understanding what motivates people is crucial to ensure maximum utility of transport investments. Using our research, we can see how different groups feel about the importance of climate compared with their willingness to switch to a more sustainable type of transport.

While carbon emissions are not a key concern when choosing a transport method for either sidelined strivers or defiantly disengaged, there is a noticeable difference in their attitude towards switching transport modes. Sidelined strivers are equally willing to switch to cycling or public transport, while defiantly disengaged are much more open to switching to public transport than cycling. It is therefore important to understand not just how to encourage change, but also what transport options your population might be open to.

Different areas will have different proportions of our segments within them. For example, sidelined strivers make up 16% of the overall population but only 12% of mostly rural populations.

This results in different attitudes prevailing in different regions. In more urban areas such as Stoke-on-Trent and Harlow large numbers of the population (51% and 50% respectively) say they could not afford to change their habits to be more sustainable. To encourage a modal shift in places such as these it would be necessary to explore how sustainable travel options could be affordable.

Read the full story on the Local Government Chronicle here.

About our Sustainability Segmentation

Our Sustainability Segmentation uncovers how society is embracing – or resisting – a desire to meet sustainable goals, even during a deep and global economic crisis, setting out to help marketers effectively communicate, and market, sustainability in a manner that directly connects with customer values.

The seven segments identified within the report are based on consumer awareness, knowledge, ability to care and behaviours; from Committed Changemakers who have a positive, internationalist world view and hold left-leaning values to the Defiantly Disengaged, those holding strong right-leaning values, who are pessimistic and individualistic and prefer to ‘go it alone’ than trust experts or established institutions.

Download our free report here to read more about your audience segments.

Notes:

The report is based on the findings of a survey of 12,016 adults aged 18+ in the United Kingdom (5,005), United States (5,006) and Canada (2,005). Data are weighted to be representative of age, gender, region and social grade (UK) or income/education (US and Canada).

Download the full report: