The new Consumer Duty regulation, delivered by the Financial Conduct Authority (FCA), could arguably not have come at a better time for consumers, as they try to navigate the myriad of financial service products and organisations available to them during these turbulent economic times.

It is not enough to simply say the customer experience is compliant, organisations need to prove it is.

Even before cost-of-living pressures emerged, consumers were being asked to make an increasing number of complex and important decisions in a faster and increasingly complex environment, as stated by the FCA.

For retail customers, Consumer Duty has a clear aim; setting higher and clearer standards for organisations supplying products and services. In layman’s terms, better protection of retail customers and promotion of competition amongst organisations and service providers.

Putting proposition into practice

So how will this be achieved?

The FCA has stressed the importance that this is an “outcome focused” set of rules and guidelines, rather than formulaic rules on what organisations have to do or deliver. They ultimately believe that this will give organisations greater flexibility to adapt and innovate. From experience and previous FCA requirements such as Treating Customers Fairly (TCF) in 2006, we do know however that this can lead to areas of vagueness and not knowing exactly what is required and how to prove it!

What we see as a core piece of the duty is the need to evidence that customers see and feel a positive experience, avoiding potential harm and where any actual harm is incurred, it’s promptly identified, and changes made. It is not enough to simply say the customer experience is compliant, organisations need to prove it is.

This duty will affect provider’s processes, technology, staff and skillsets, as all types of customers (including the vulnerable) interact across a huge variety of channels across digital, in-person, telephone and written.

Building a suitable framework

A core area of focus for Savanta around Consumer Duty is the testing of consumer comms.

With extensive experience across both qualitative and quantitative comms testing for firms and regulators, we have drawn on best practices to develop a testing framework that allows a ‘plug and play’ approach to comms testing for consumer duty, delivering a cost and time-efficient approach that can flex with business requirement.

- Operational Excellence:

A flexible operational model which is built to meet adapting regulatory needs

- Communications Effectiveness:

A framework which provides clear, actionable communications improvements

- Advisory:

A partnership to navigate Consumer Duty with internal and external stakeholders, delivering confidence to the organisation and regulators

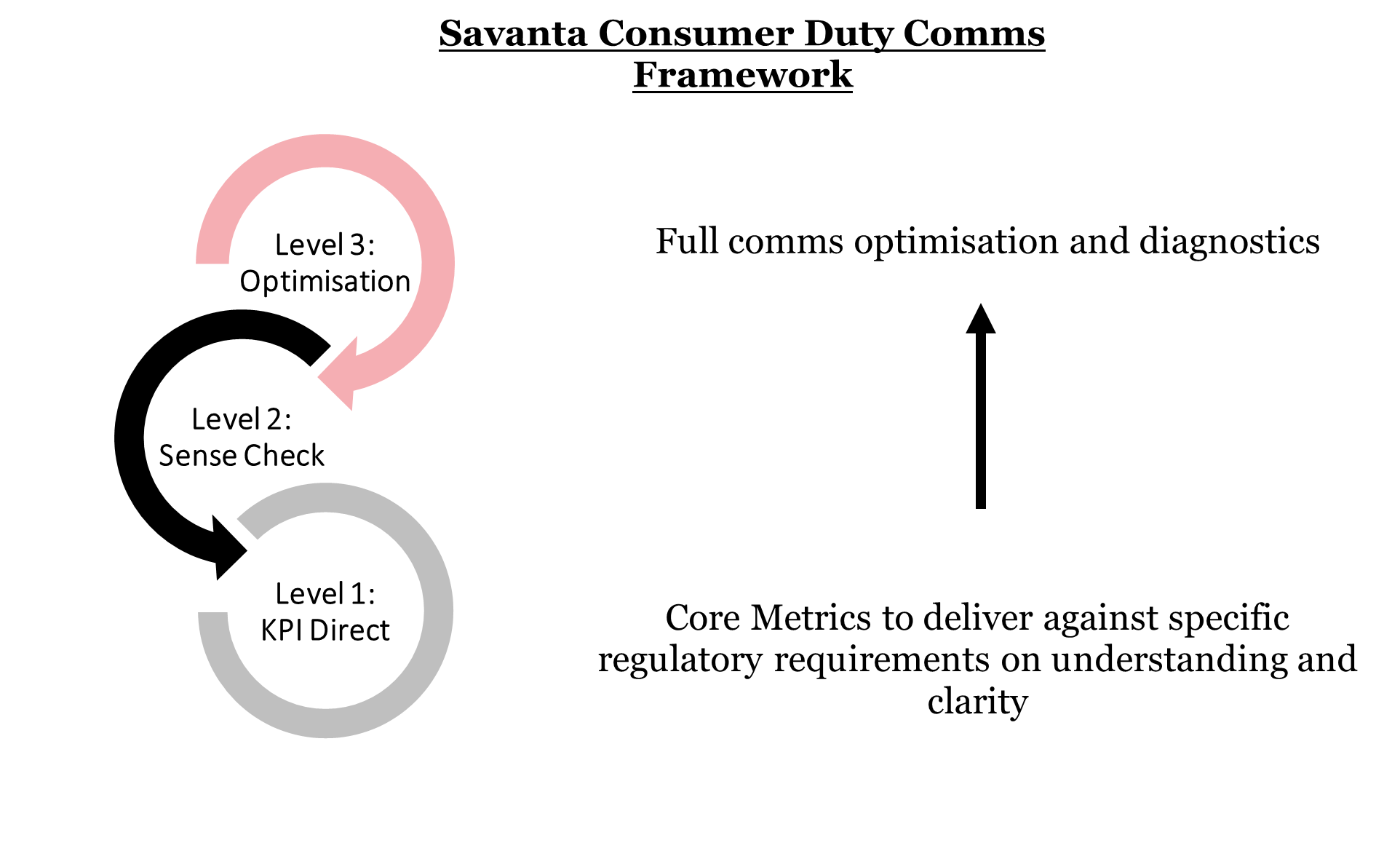

Our Consumer Duty Comms Framework is delivered through three tiers of service, selectable depending on specific business needs.

At a fundamental level, there is the need to deliver against core regulatory requirements, but at Savanta, we don’t believe it should just stop there and as such, have developed a full comms optimisation module to help deliver the greatest return on our customer interactions.

The new FCA Consumer Duty presents challenges and opportunities for organisations to go above and beyond, genuinely putting their customers at the heart of their decision-making; if you’d like to discuss with our specialist team here at Savanta what this means more practically, we would be more than happy to discuss with your team.

For further information on how we can help you navigate the new Consumer Duty Regulation and wider financial market issues please contact us.