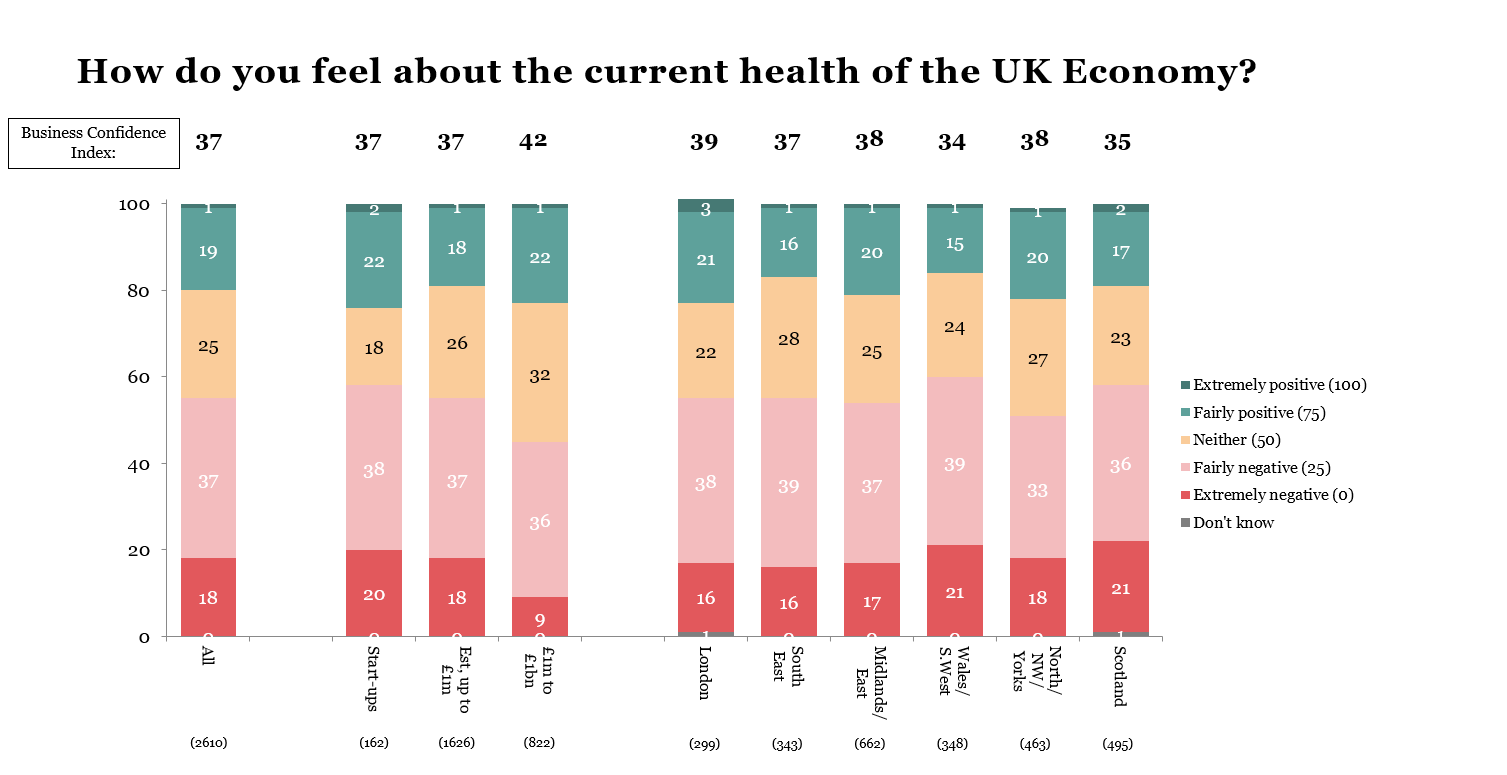

The Savanta Business Confidence Index saw a decline this quarter, from 39 in Q2 2023 to 37 in Q3 2023, although this is not significant. Confidence is now only slightly higher than it was during the first lockdown in Q2 2020, when it plunged to 35. High levels of insolvency and bankruptcy are clearly taking their toll and having a negative impact on the overall Business Confidence Index.

Confidence decreased significantly for larger businesses sizes, but not significantly for start-ups

New start-ups have a Confidence Index of 37, a decrease of -5 points compared to Q3 2023.

The Confidence Index among smaller established businesses is stable at 37. As this size of business represents the most enterprises by number, stability for this group results in the change to the overall Confidence Index this quarter being relatively small compared to the drops we see for start-ups and larger businesses.

Larger businesses, with annual sales above £1m, remain the most confident group with an Index of 42. However, this audience has experienced a significant decrease in their Index compared to Q2 2023 (-3 points).

Confidence decreased in 3 geographical regions

London is the most confident region, despite a -3 points decrease in the Confidence Index compared to Q2 2023 and is now at 39.

The North/North West and Midlands/East share second position and both have a stable Confidence Index of 38.

The South East is the next most confident region, with an Index of 37 and a decrease of -2 points.

Scotland has fallen from being the second most confident region to the second least this quarter (35) and its score decreased significantly since last quarter (-4 points).

Wales/South West has the lowest Index, stable at 34.

An Index of less than 50 means more businesses are pessimistic, rather than optimistic, about the current state of the economy.

Confidence down in most industry sectors

At Q3 2023, confidence increased in 2 of the 9 industry sectors (Accommodation and Agriculture) but decreased in 7 (Education, Wholesale, Production, Business Services, Construction, Transport and Other Services).

The greatest increase was in the Accommodation sector, with a third increase in a row this quarter, ensuring it is no longer the least confident sector (+ 4 points to 36). The Accommodation, Transport (-4 points in to 36) and Other Services (-2 points to 34) sectors are all below average.

The Agriculture, Construction and Business Services sectors all have equal Confidence Indices (37). However, Agriculture shows an increase of +2 points whilst Construction and Business Services both decrease by – 2 points.

The Wholesale and Production sectors have the same Confidence Indices (38) and, whilst this is just above average, they have both declined by -1 point.

Education is in first position with a score of 43, despite a -6 point drop this quarter.

Amongst start-ups and small businesses, Business Confidence decreased for up to 34 year-olds and 65+

Looking at start-ups and established businesses with a turnover of £0-2m, Business Confidence decreased for younger business owners (up to 34 year-olds), but not significantly so (-3 points to 36).

Those aged 65 and over remain the most confident group this quarter, but their score decreased by -3 points to 39.

Scores for those aged 35-64 remain stable at 37.

Commenting on the findings Philippa Whitham, Senior Director at Savanta, said:

“Signs of recovery in Q1 and Q2 gave us hope for further improvement in Q3. However, in the end, persistent inflation, high interest rates and declining consumer spending have all taken their toll. Latest government figures show a spike in insolvency and liquidations towards the end of Q2, which no doubt contributed to the ongoing feeling of precariousness. It currently feels unlikely that confidence will improve during Q4 as businesses continue to face ongoing economic pressure.”

Download the infographic

About Market Vue Business Confidence

Quarter findings are from Savanta’s Market Vue Business Confidence programme conducted among 2610 GB businesses from start-ups to companies with £1bn turnover, surveyed from between 24th June 2023 – 18th September 2023. Indices are mean scores based on a scale of ‘extremely positive’ (100), ‘fairly positive’ (75), ‘neither positive nor negative’ (50), ‘fairly negative’ (25) and ‘extremely negative’ (0), for the question “How do you feel about the current health of the UK economy?”

For more information contact us at [email protected].