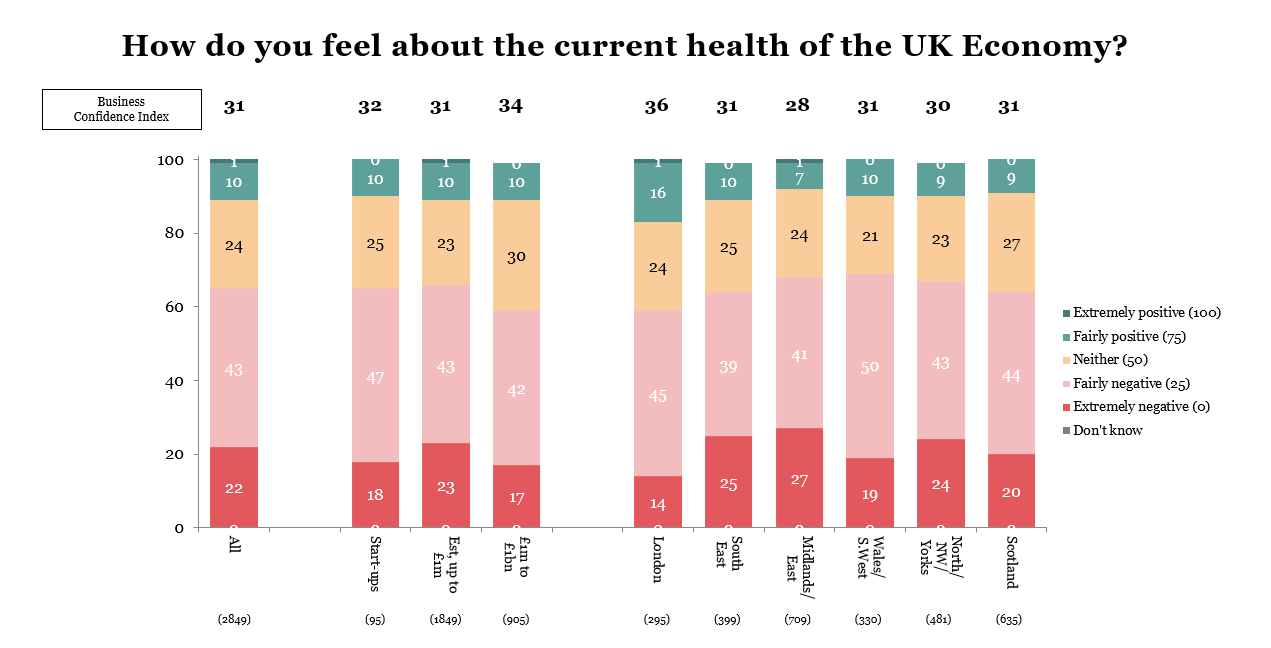

Lower confidence: no gains for start-ups, established or large businesses

This quarter, confidence decreased for all business. Start-ups and Established businesses with a turnover up to £1m saw a slight decrease of -1 point to 32 and 31. Larger businesses with a turnover of £1m+ saw a larger, and significant, decrease of 3 points to a score of 34.

Confidence decreased slightly for most UK regions

The most pessimistic region is the Midlands / East with a Confidence Index of 28, whilst London retains the most confidence with an index figure of 36, increasing slightly by 2 points.

The biggest change was within the Midlands / East significantly decreasing -4 points. Elsewhere, regions saw a slight decline in confidence.

The highest confidence amongst sectors is with Transport, Education and Business Services

Education and Agriculture saw increases of +3 and +4 respectively, while Transport experienced a significant increase this quarter (+8 points).

For Q3 2025, confidence decreased in five of the nine industry sectors. Two of those five sectors saw larger statistically significant decreases of -7 and -5 (Construction and Production, respectively). The Construction and Accommodation sectors have the lowest Confidence Index (27) overall.

Confidence decreased amongst ages 35+

Business Confidence increased for younger business owners (up to 34-year-olds) by 1 point to 34. Business Confidence decreases to 31 for 35–64-year-olds (-1 point) and to 30 (-3 points) among older business owners (65 and over).

Commenting on the findings Helen Davey, Director at Savanta, said:

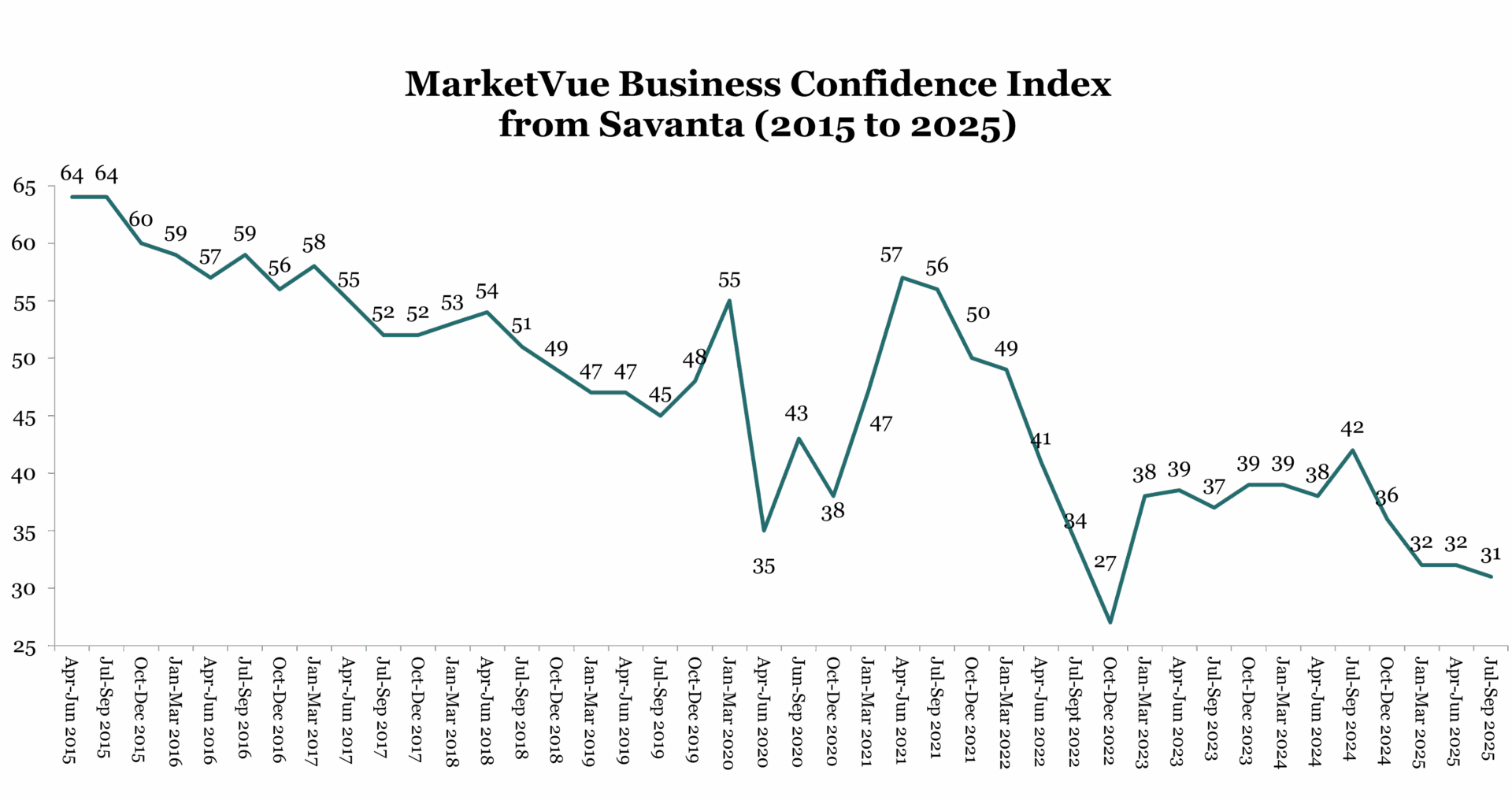

“UK Business Confidence has remained subdued throughout 2025, with Q3 seeing a further -1 point decline from Q2. The Savanta MarketVue Business Confidence Index now stands at 31, signaling continued pessimism among UK businesses regarding the country’s economic prospects – a pattern that has persisted in recent quarters.

While the latest quarter’s dip is marginal, confidence levels appear to have settled, marking two consecutive periods without major swings. This stabilisation suggests that the initial impact of early-year shocks (driven by ongoing global trade disruptions and elevated geopolitical tensions) may be fading. However, businesses are still operating in an environment of uncertainty, and external risks continue to weigh heavily, helping to explain the consistently low scores on the Index.

Mirroring muted confidence, the UK economy has posted only modest growth rates in recent months. This restrained expansion, combined with high operating costs and supply chain challenges, is likely restricting optimism in the business community.

Looking ahead, there are tentative signs of optimism. The IMF (International Monetary Fund) has recently revealed its outlook, predicting the UK could be the second fastest growing G7 economy in 2025. This suggests potential for a gradual recovery in sentiment. However, any uptick should be approached with caution; the IMF also warns that the UK is expected to face higher inflation than other major economies driven by rising energy and utility bills, which may continue to challenge businesses’ outlooks and dampen the pace of confidence rebuilding.”

About MarketVue Business Confidence

Quarterly findings are from Savanta’s MarketVue Business Confidence programme conducted among 2849 GB businesses from start-ups to companies with £1bn turnover, surveyed between 23rd June 2025 – 17th September 2025.

Indices are mean scores based on a scale of ‘extremely positive’ (100), ‘fairly positive’ (75), ‘neither positive nor negative’ (50), ‘fairly negative’ (25) and ‘extremely negative’ (0), for the question “How do you feel about the current health of the UK economy?”

For more information contact us here.