Gen Z are struggling with dating app fatigue; 21% of young people who are single and actively looking for a partner, no longer use dating sites they’re registered with.

The pandemic took a toll on relationships, but young people adapted quickly and found new and creative ways to date during lockdown. They had to put more effort into their relationships and as a result, began creating more meaningful and lasting connections.

In this article we use data from our Gen Z insight tracker, State of the Youth Nation to reveal four pre and post pandemic Gen Z dating trends, uncovering how these will influence the future of dating and what impact they will have on businesses.

1. Gen Z’s changing their approach to dating

Before lockdown Gen Z took a casual approach to dating. Dating apps were a way to pass the time. 45% of 16-24s said the main reason they use these apps is “to have something to do” (State of the Youth Nation).

But in a world after lockdown, Gen Z have become more reflective. Being stuck inside made us think about the relationships we have, and we put more effort in to maintaining them.

Watch the video to hear about Gen Z’s love lives in lockdown:

With Gen Z becoming less spontaneous daters, will they become less spontaneous consumers?

2. Creative ways to love through lockdown

Lockdown encouraged Gen Z to communicate more creatively and meaningfully to maintain connections.

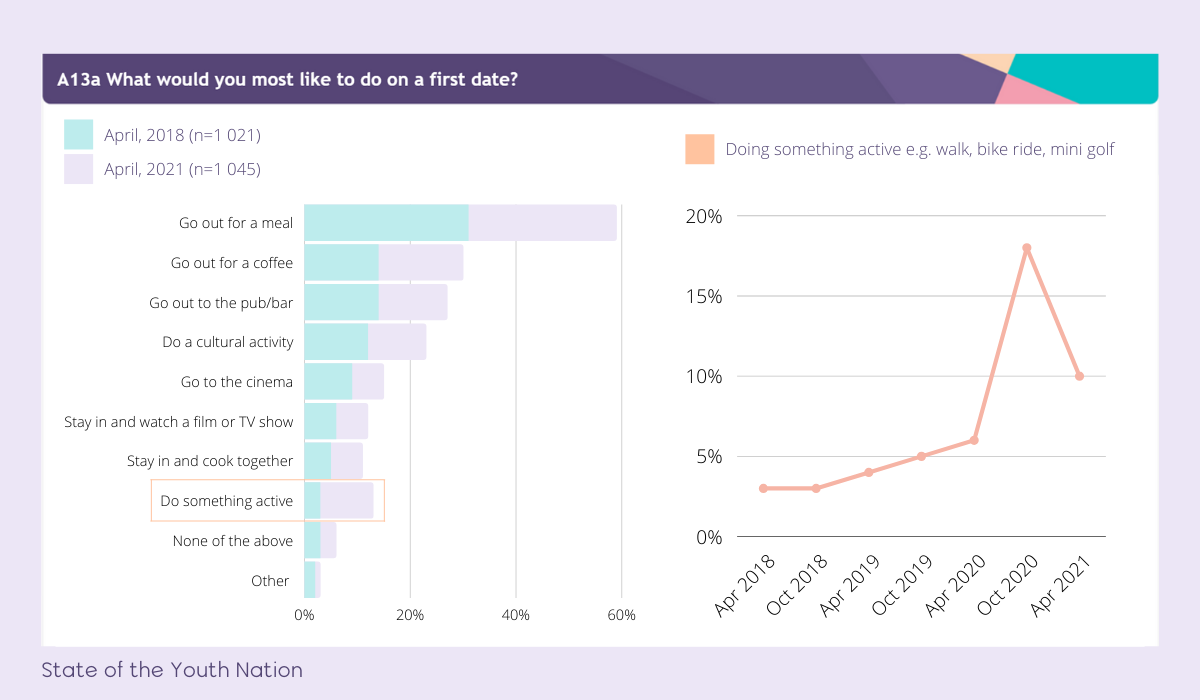

Active, outdoor dates become more popular during lockdown, but going out for a meal remains the top choice for a first date this year (State of the Youth Nation, 2021).

Hear about Gen Z’s worst dates stories:

With Gen Z becoming less spontaneous daters, will they become less spontaneous consumers? Brands can learn from Gen Z’s creativity and communicate more innovatively with young consumers.

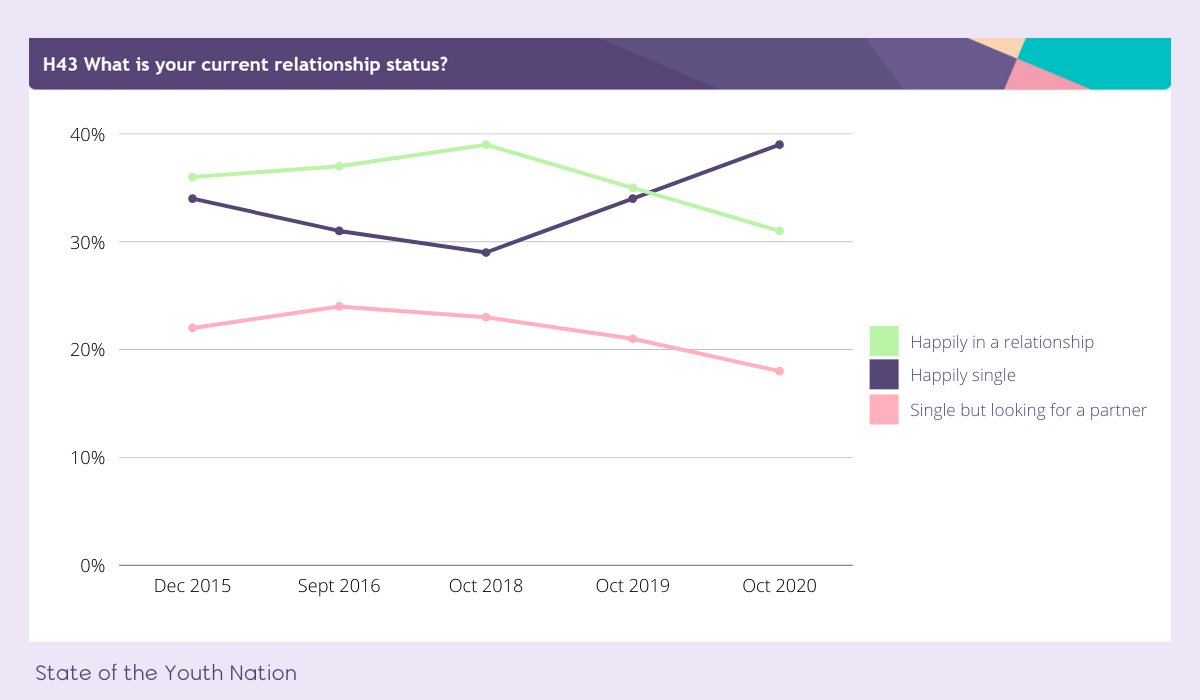

3. Gen Z is redefining what it means to be single

Before the pandemic hit, Gen Z were challenging stigma attached to ‘being single’ and this trend continues in 2021.

Unlike generations before them, Gen Z don’t feel pressure to be in a relationship. Our data reveals that over a third of 16-24s describe themselves as “happily single” (State of the Youth Nation, 2021) – and lockdown has amplified this (see trend chart below).

In October 2020 almost 40% of young people would describe themselves as “happily single” and fewer were “happily in a relationship” or “looking for a partner” than in pre-pandemic times.

When asked why they stay single, more than half said they want to prioritise their own needs.

4. The highs and lows of online dating

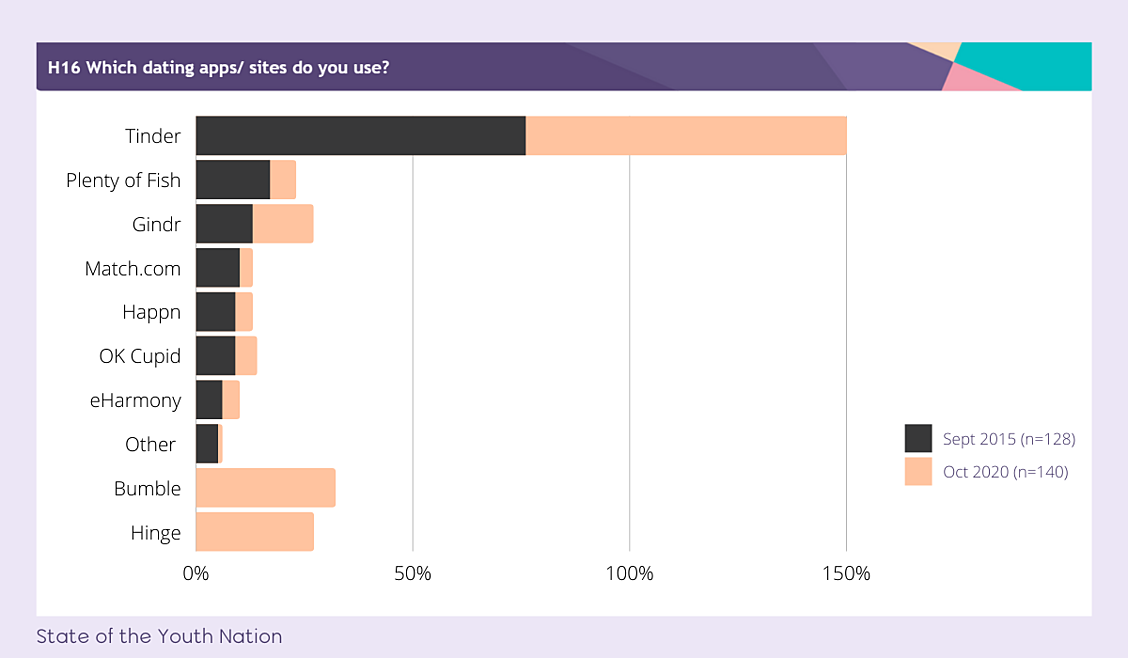

Young people have increasingly turned to dating apps and websites to find relationships. In 2018 28% of 16-24s were registered with at least one dating app, which was up from 22% three years earlier (State of the Youth Nation).

During the pandemic, Tinder continued to dominate the market. Tinder reports an increase in daily conversations by 12% during lockdown and over three billion swipes globally. However, usage hasn’t changed considerably over the last five years, according to our trend data (see chart below). But we can see new entrants emerging in the market.

The appetite for online dating has caught the attention of brands such as Facebook, who were hungry for a share of the market. We even saw the emergence of niche dating sites specialising in online dating during lockdown.

But, we’re just scratching the surface. Our data also reveals evidence that Gen Z are struggling with dating app fatigue; 21% of young people who are single and actively looking for a partner, no longer use dating sites they’re registered with (State of the Youth Nation, 2018).

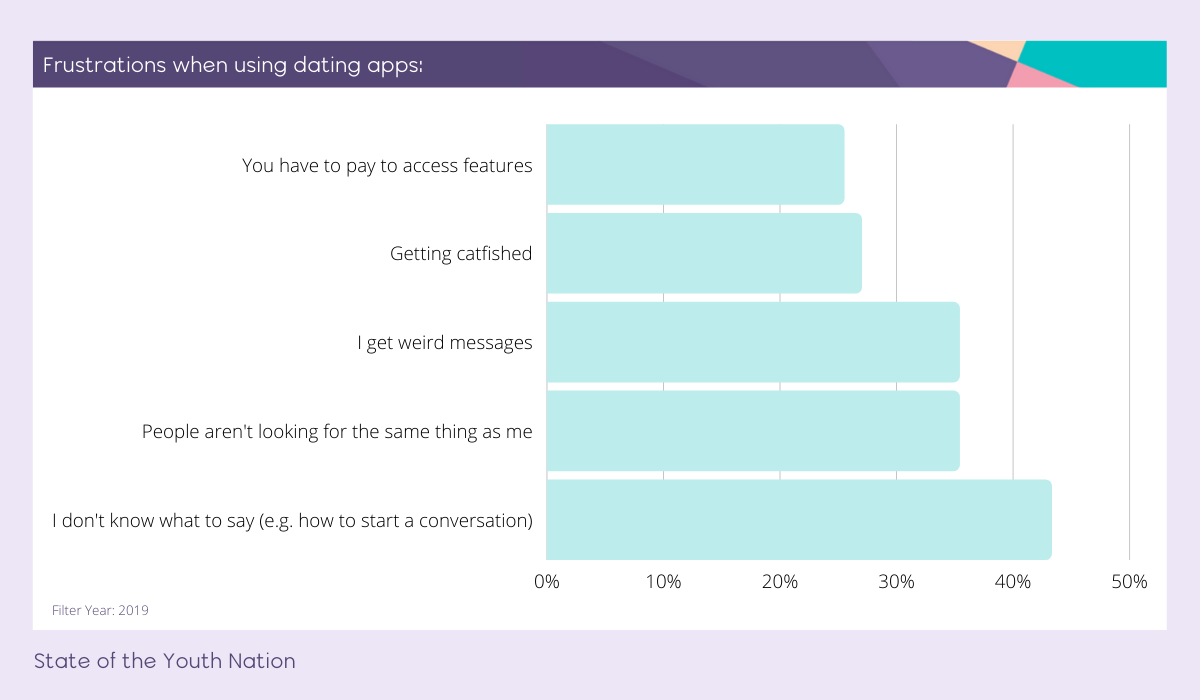

Over 90% of Gen Z claim at least one frustration with using dating apps.

Looking to the future: What does this mean for businesses?

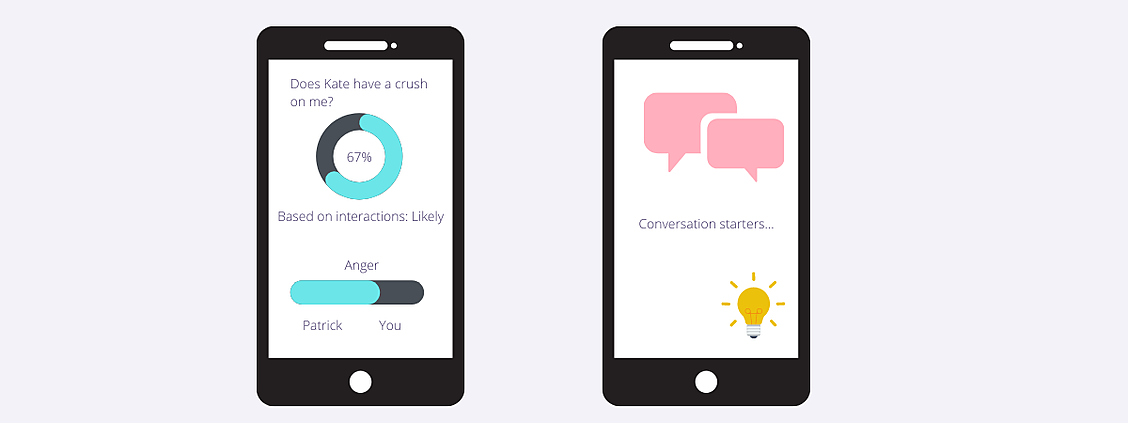

The use of AI during lockdown helped keep Gen Z connected and it may have sped up it’s involvement in the future of dating.

AI assistant apps are emerging in the market and we predict that this trend along with virtual dating is here to stay in a post-pandemic world.

Mei is a mobile messaging app that includes an AI assistant to improve your relationships. It analyses your text conversations and can help you to understand how you come across to others, whilst revealing new things about your relationships.

Aysa helps couples to have more meaningful conversations. It provides you with thousands of topics to talk about and listens to you whilst you speak to each other. It then provides detailed feedback about the emotions in your voice to tell you how well you are saying things and also tells you how well you are listening.

Gen Z are becoming comfortable with having this type of tech in their everyday lives. Imagine the competitive edge it could give your brand if you had a virtual step in your customer journey – would it win over Gen Z?

State of the Youth Nation

The trends identified in this report were informed by tracking data extracted from State of the Youth Nation.

A subscription to this tracking product will give you unlimited access to Gen Z insights that’ll help you connect better with the next generation of consumers.

State of the Youth Nation keeps brands plugged in to youth trends, with with 700+ questions that uncover what young people care about, where they’re headed and their digital worlds.

*BRAND NEW* functionality of the dashboard also empowers users to browse the data by topic area, dig into the trends you want to know about, filter by demographic variables, track trends over time and export all the data you need at the touch of a button.

Click here to download the brochure and see the data that will change your business. Join leading brands (including ITV, Channel 4, Ofcom and The FA) and make better youth marketing decisions.