Mixed confidence gains for established and large businesses, but not start-ups

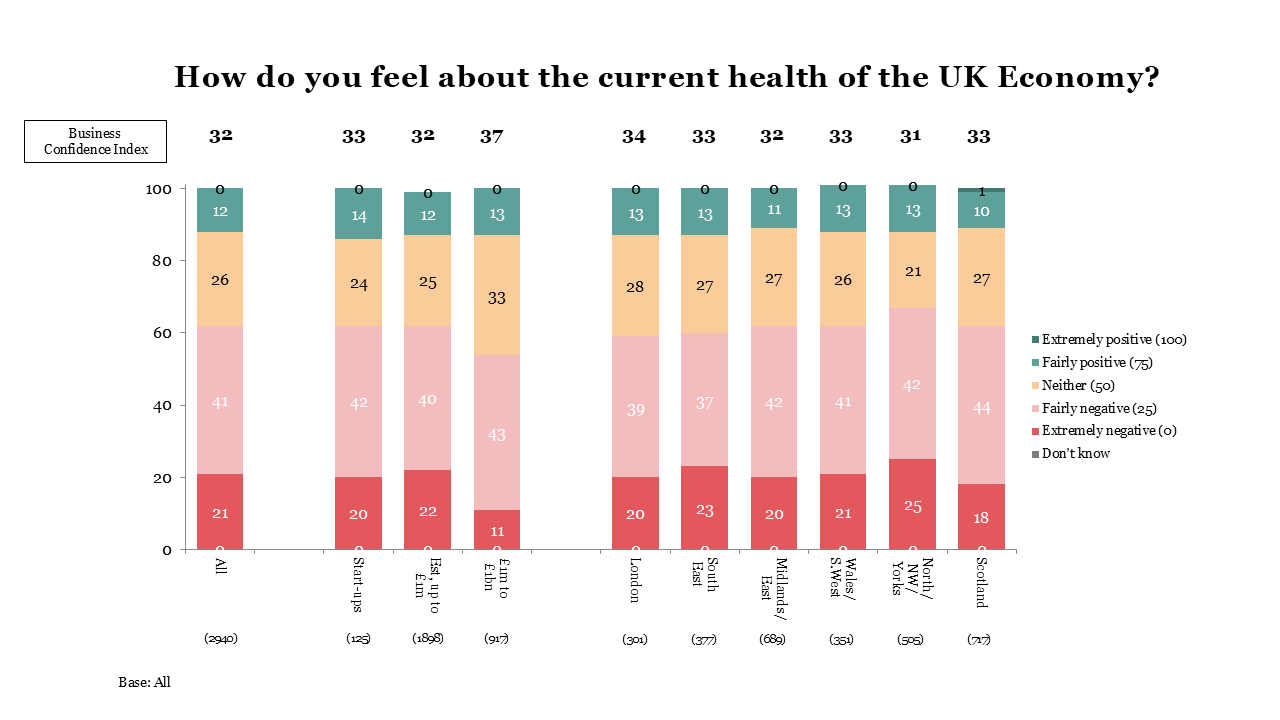

This quarter, confidence increased slightly for small businesses (with turnover up to £1m), significantly for large businesses and established businesses with turnover up to £1m at 32 (+1pp) and large businesses with turnover £1m+ at 37 (+3pp). However, start-ups saw a slight decrease of -3pp to 33, which was not significant.

Confidence increased slightly for most UK regions

The most pessimistic region is the North with a Confidence Index of 31, whilst London retains the most confidence with a Confidence Index figure of 34. The biggest significant changes were within North/NorthWest (-3pp) and Midlands/East (+2pp), respectively.

Confidence dropped in some sectors with Agriculture and Transport remaining the lowest-scoring sectors

For Q2 2025, confidence decreased in four of the nine industry sectors. Three of those four sectors (Transport, Education and Accommodation) saw larger decreases of -7, -5 and -4 points, whilst Wholesale saw a smaller downward change.

The Agriculture sector has remained the lowest Confidence Index (25). Transport is the second lowest sector in Business Confidence (26), recording a significant -7 point fall.

Construction and Business Services saw an increase, while Production experienced a significant increase this quarter.

Amongst age, confidence rises among older business owners, falls for under-35s

Business Confidence decreased for younger business owners (up to 34-year-olds) by -3 points to 33 and remained stable to 32 for 35–64-year-olds. For the older business owners (65 and over), the Confidence Index increased significantly by +3 points to 33.

Commenting on the findings Rosaria Vitale, Associate Director at Savanta, said:

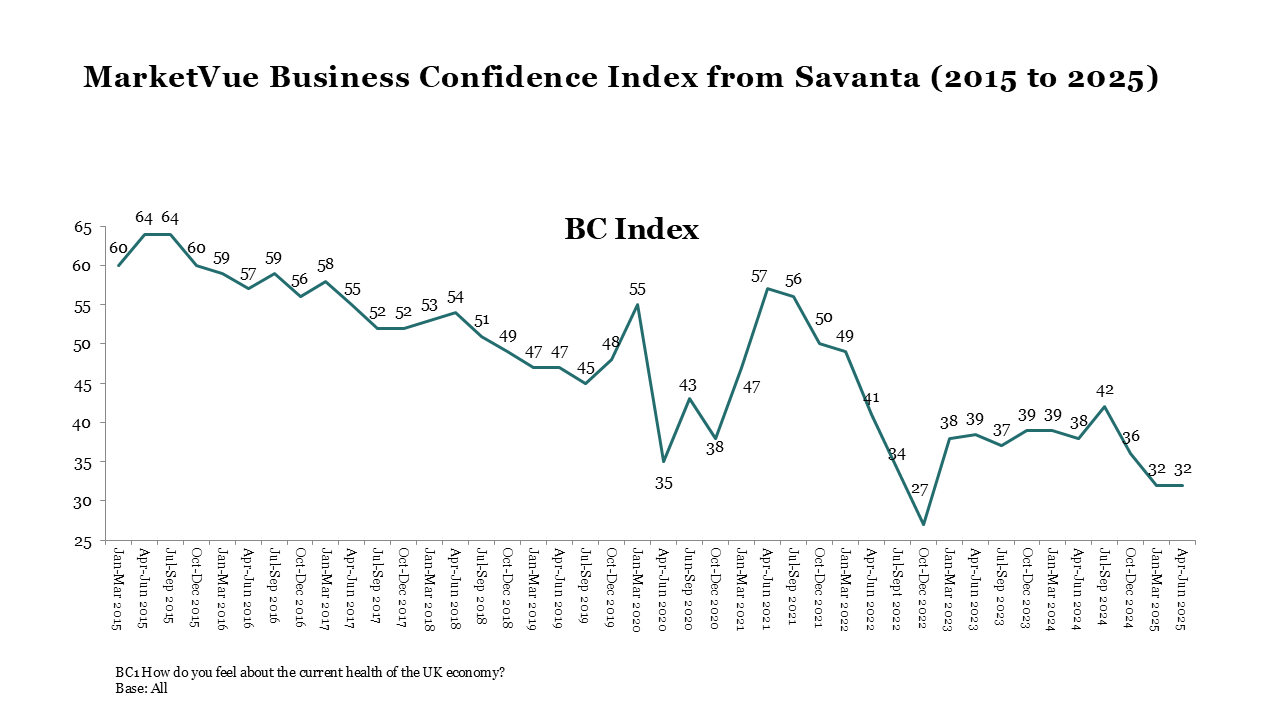

“The Savanta MarketVue Business Confidence Index held steady at 32 this quarter, indicating that, while optimism has yet to recover, the pace of deterioration has slowed, and sentiment is stabilising at this lower level.

The fact that business confidence has remained unchanged this quarter comes against a backdrop of ongoing uncertainty from global trade disruptions, including new tariffs and shifting international policies, alongside persistent inflation, rising business costs, and regulatory change. These pressures continue to weigh most heavily on internationally exposed and consumer-facing sectors. Many businesses also flag weak domestic demand and concerns about the tax burden as obstacles to recovery.

The absence of any significant upturn reflects continued caution about sales prospects and investment decisions. Nonetheless, with most headline metrics broadly unchanged versus Q1, there are tentative signs that confidence may be reaching a floor.

Looking ahead, greater clarity on global trade relations, management of inflation, and clear fiscal policy will be critical for supporting any future rebound in UK business confidence.”

About MarketVue Business Confidence

Quarterly findings are from Savanta’s MarketVue Business Confidence programme conducted among 2940 GB businesses from start-ups to companies with £1bn turnover, surveyed between 25th March 2025 – 20th June 2025.

Indices are mean scores based on a scale of ‘extremely positive’ (100), ‘fairly positive’ (75), ‘neither positive nor negative’ (50), ‘fairly negative’ (25) and ‘extremely negative’ (0), for the question “How do you feel about the current health of the UK economy?”

For more information contact us here.