Think about how targeted the ads are across your various social media platforms. They seem to know what you want before you even think about it! Businesses invest a significant portion of their budgets to keep their audience engaged longer. Savanta’s most recent Business Tracker surveyed 1,000 UK business decision-makers to find out which social platforms are the most preferred for advertising.

Advertising landscape: Meta leads, while X faces challenges

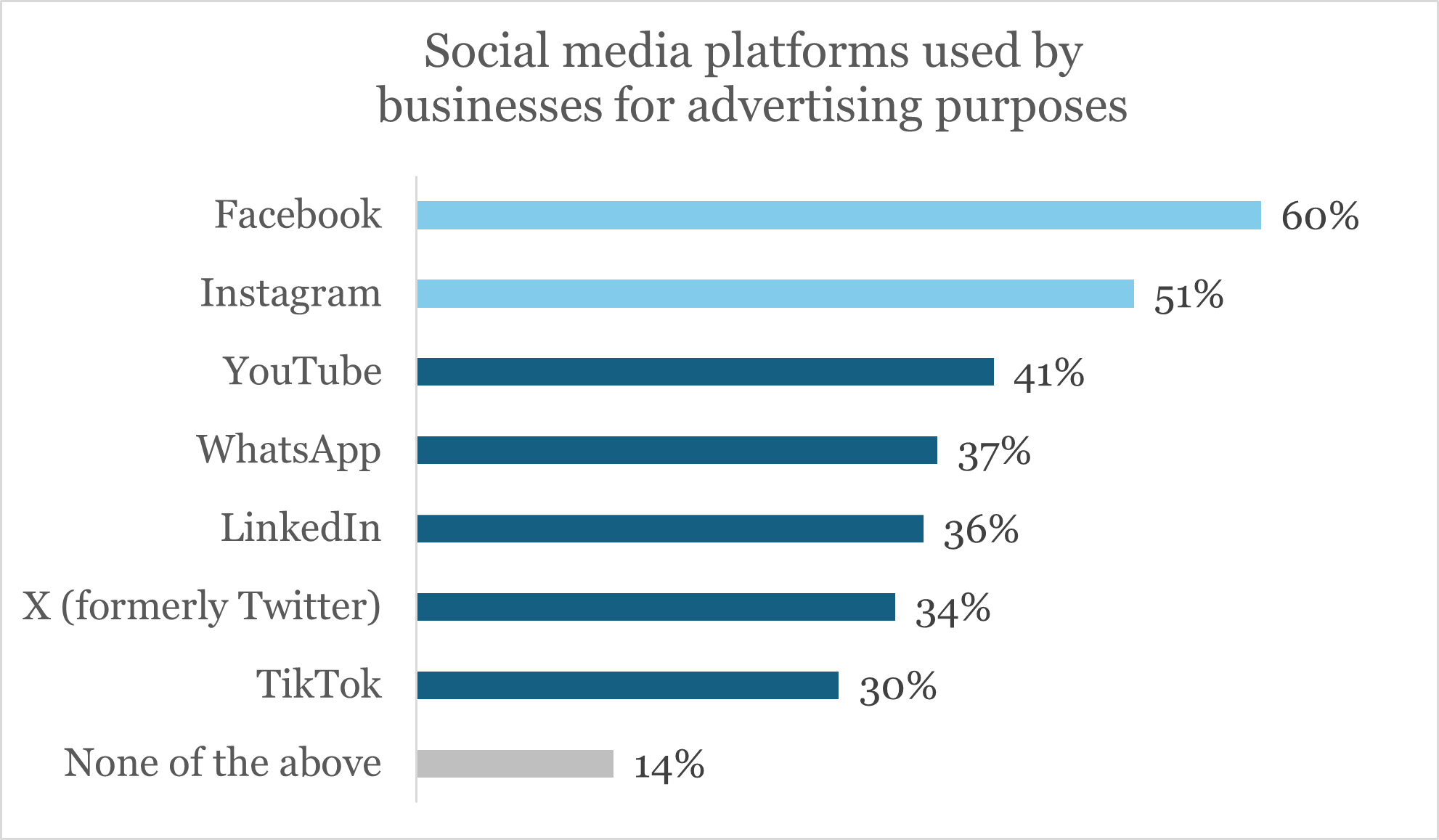

Businesses utilise a wide range of platforms to engage different customer segments, but Facebook is the leader, used by 60% of businesses. Instagram, another Meta-owned company, follows at 51%. Only 34% of businesses currently advertise on X (formerly Twitter), leaving X as 6th choice for advertising, behind YouTube (41%) and LinkedIn (36%).

Unsurprisingly, business size and revenue have an impact on use of social media platforms.

Almost all (98%) medium/large businesses (250+ employees) advertise on social media compared to 82% of small businesses (under 250 employees). Medium/ large businesses also advertise more across all platforms compared to their small counterparts. For example, 69% of medium/large businesses currently use Facebook for their business ads, compared to 57% of small businesses, while use of X is almost twice higher among medium/large businesses than smaller ones (52% vs. 28% respectively).

Similarly, businesses with £1m+ revenue are more likely to use each platform for advertising than those with lower annual revenues. While the gap is smaller for Facebook, used by 55% of lower-revenue businesses (less than £1m) compared to 65% of those with £1m+ revenue, for X the gap is significantly bigger. The formerly Twitter platform is used by only 21% of lower-revenue business compared to 46% of higher-revenue counterparts.

X currently lags behind Meta platforms, Facebook and Instagram, across UK businesses.

Trust concerns impacting X’s popularity

Advertising is fiercely competitive; businesses want to ensure their investments yield returns. Potential misinformation can deter platform usage, as reputational damage erodes trust among target audiences.

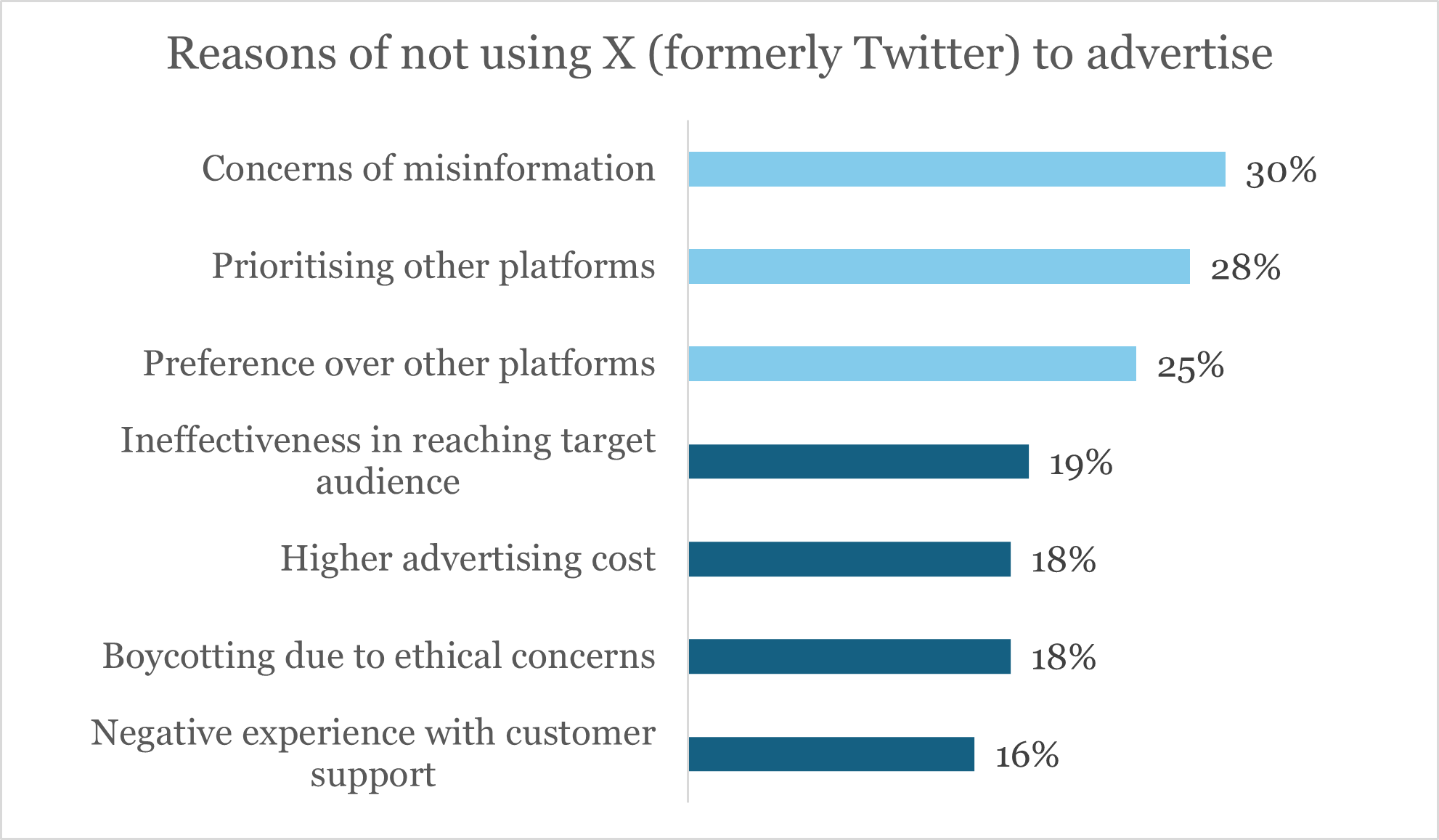

When asked why they avoid X for advertising, 30% of businesses cited misinformation as the top concern. This theme has been recurrent in the media among businesses, regular users, and advertisers since the platform’s acquisition and subsequent drastic changes.

On top of concerns over misinformation, more than a quarter of businesses who do not use X are prioritising other platforms (28%). Within this group, 70% are using Facebook and 58% are using Instagram to advertise instead of X.

Preference over other platforms due to unique advertising features are also one of the top reasons of not using X, as reported by 25% of businesses that don’t advertise in this platform. Moreover, businesses with international operations (34%) are significantly more likely than domestic businesses (21%) to cite preference as the reason of not using X.

Making the right choice

Each social media platform offers distinct strengths, but stability, reliability and effectiveness are paramount.

In the competitive realm of advertising, businesses seek stability and trust, and those are the key elements that businesses haven’t been fully convinced with X currently. On the other hand, Meta-owned Facebook and Instagram continue to be the go-to platforms for either small or medium/ large businesses, as they seek to maximise the return of investment with their advertisement placements.

Is your advertising strategy leveraging the most effective platforms? Contact Savanta to uncover insights tailored to your business needs.

About the Savanta Business tracker

Our monthly (UK) and quarterly trackers (Europe) monitor the recovery, resilience and adaptation of businesses. We offer you a timely and cost-effective solution to help you understand the wider sector context better, let it be the latest impact of new regulations or the latest trend in AI usage, we’ve got you covered!