The low-income Sidelined Strivers are significantly less likely than all other segments to use cars daily (24%).

Appetite for electric vehicles is on the rise for reasons transcending sustainability. But with a third (30%) of consumers still using petrol/diesel cars every day, it’s no surprise, that the journey towards emission-free transportation is long and winding.

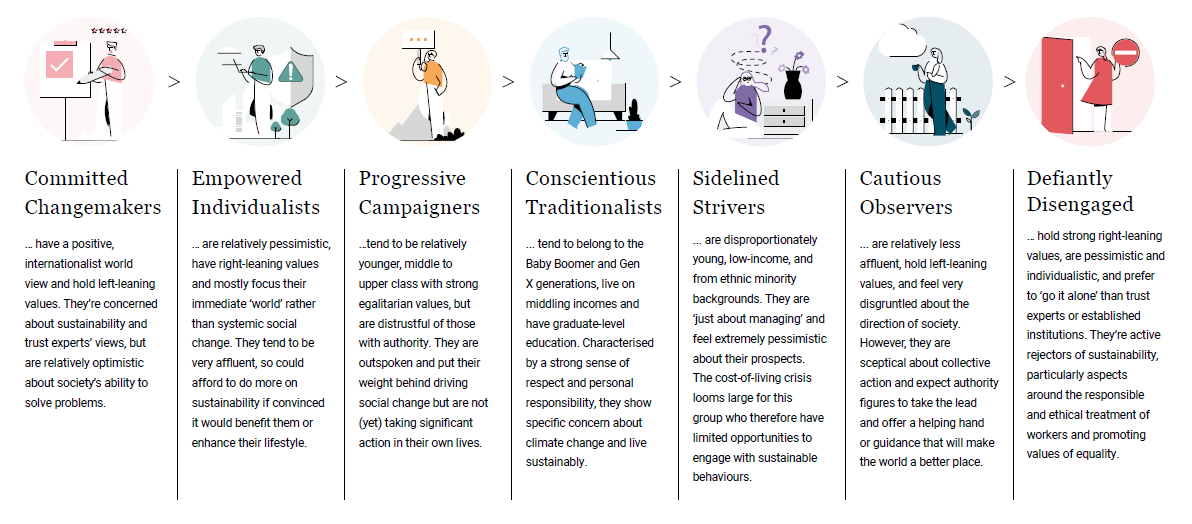

In our Sustainability Segmentation report, we identified seven consumer segments based on awareness, knowledge, ability to care and behaviours, in order to understand how intentions and actions towards sustainability vary across the Travel & Transport sector. Within this article, we reflect on these findings and interpret what this means for businesses.

About the study

The report uncovers how society is embracing – or resisting – a desire to meet sustainable goals, even during a deep and global economic crisis. We set out to help marketers effectively communicate, and market, sustainability in a manner that directly connects with customer values.

How are the segments defined? Our findings identified that the public falls into seven segments; from Committed Changemakers who have a positive, internationalist world view and hold left-leaning values to the Defiantly Disengaged, those holding strong right-leaning values, who are pessimistic and individualistic and prefer to ‘go it alone’ than trust experts or established institutions.

Download our free report here to read more about your audience segments.

Travel priorities

Our study revealed that cost, speed and comfort are the key priorities for consumers when deciding how to travel. In other words, convenience is king, with safety and journey distance top hygiene factors. Carbon emissions are in fact the least important consideration overall when making a journey.

But despite this, over half of consumers from all segments (bar one) would consider buying an electric car; with the Defiantly Disengaged very close behind (47% would consider this purchase). It’s perhaps one example in the realm of sustainability where it pays to be a status symbol.

Download our infographic to see how these considerations vary across segments.

Urban areas are shifting away from cars

More broadly, those living in urban areas are widely being encouraged to travel by alternative means, such as cycling and walking. At least a quarter have already taken steps to travel more sustainably – even if their main intention is to save money or exercise.

The low-income Sidelined Strivers are significantly less likely than all other segments to use cars daily (24%), and one in five (22%) have already reduced the number of vehicles they own.

So what?

- To succeed, sustainable travel solutions must factor-in consumer priorities (convenience and cost).

- There’s an opportunity to market electric vehicles as modern status symbols for more affluent segments.

- Investment in infrastructure and technologies that support cycling and walking will be welcomed.

Are environmental considerations taking a back seat?

Affordable air travel has democratised an escapism consumers are not willing to give up. Yet the majority (53%) need more convincing before considering carbon offsetting. Even the most pro-environment consumers need reassurance around how companies are tackling carbon offsetting; detailing where the money is going, and to what extent it offers a solution.

It’s likely that alternate emission-free fuels would be a better-received solution for the aviation industry in the long-run.

Whichever way sustainable travel evolves, our research suggests that cost and convenience will continue to be crucial.

What can brands do?

- Differentiate your offer through authenticity: can you deliver solutions that don’t just come across as add-on costs?

- Communicate green efficiencies: can you soften concerns about carbon emissions by highlighting your positive changes?

- Target your audiences: is there an opportunity for you to target and attract those looking to go abroad without flying, or capturing attention of staycationers?

Download our infographic to read more around what this means for your business or access the full report via the below form.

Notes:

The report is based on the findings of a survey of 12,016 adults aged 18+ in the United Kingdom (5,005), United States (5,006) and Canada (2,005). Data are weighted to be representative of age, gender, region and social grade (UK) or income/education (US and Canada).

Our segments include:

Download the full report: