Lower confidence: declines for start-ups, established and large businesses

This quarter, confidence decreased significantly for larger businesses of £1m+ turnover (-3 points) and for established businesses up to £1m (-3 points), with start-ups also seeing a slight decrease (-3 points).

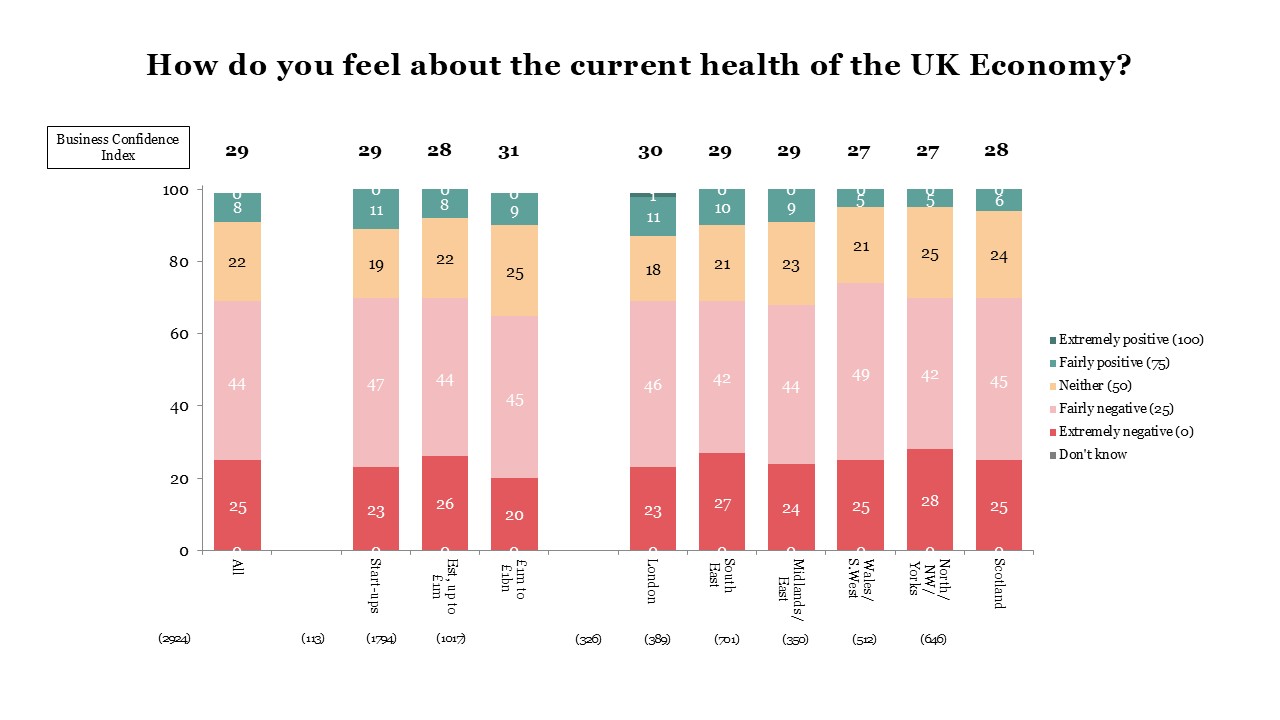

Confidence decreased slightly for most UK regions

The most pessimistic regions are the North, North West, Wales and South West regions with a Confidence Index of 27, whilst London retains the most confidence with an index figure of 30, even though decreasing significantly by -6 points.

The next biggest change after London was within the Wales and South West, significantly decreasing by -4 points, and Scotland significantly decreasing by -3 points. Elsewhere, other regions saw a slight decline in Confidence, with only Midlands and the East seeing a small increase of +1 point, reaching a Confidence Index of 29.

Confidence is broadly low across all industry sectors

Confidence has decreased across 7 of 9 industry sectors in Q4 2025. The significant and largest declines occur in the Education (-13 points), Transport (-8 points) and Business Services (-4 points) sectors.

Elsewhere, Wholesale, Accommodation, Production and Other Services experience a slight decline this quarter. Agriculture sees no change in Confidence since Q3 2025, whilst Construction is the only sector to see a slight increase (+2 points).

Confidence decreased amongst all ages

Confidence has decreased across age groups, with under 35s dropping by 2 points, 35 – 64s significantly dropping by 3 points and the over 65’s significantly dropping by 2 points.

Commenting on the findings Helen Davey, Director at Savanta, said:

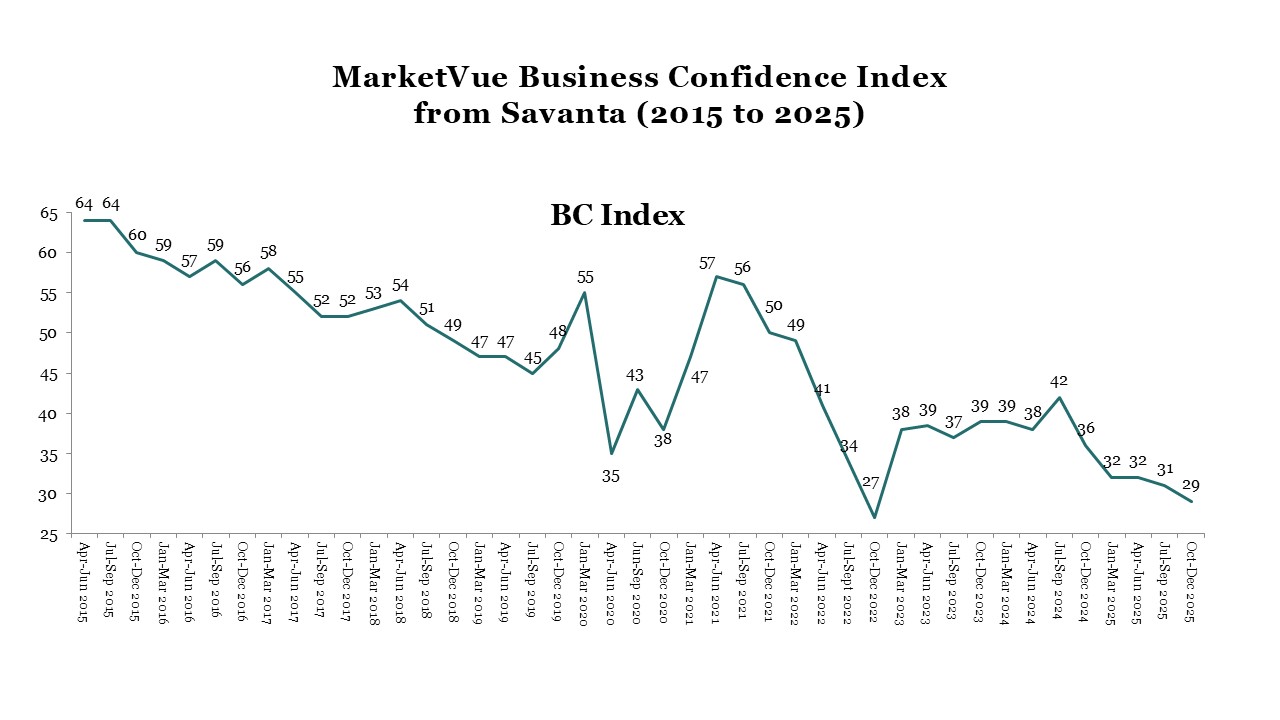

“UK Business Confidence has once again seen a decline in Q4 2025, continuing a negative trend over the last 15 months and closing what has been an eventful year for UK businesses. The Confidence Index currently sits at 29 – the second lowest measure recorded in over a decade of tracking (behind Q4 2022’s score of 27 amidst the turbulence of the short-lived Liz Truss government).

Whilst it was hoped that the build up to Christmas may have encouraged spending across retail and hospitality sectors resulting in an uptick of Confidence, this does not appear to have come into fruition. As Q4 progressed, optimism stalled, likely driven by attention for the Autumn Budget and the threat of tax hikes knocking consumer confidence. Despite some indications of more agreeable conditions for growth ahead, such as with the US stock market ending 2025 on a high perhaps driven by AI investments, the overall feeling among UK businesses is of caution.

Looking into 2026, we would hope to see this trend start to reverse and Confidence build again. However, this growth may not be instant. The year has already been characterised by geopolitical tensions and threats of trade wars being exchanged. At the time of writing in January 2026, we have seen the price of gold increase at historic levels, with the performance of this “safe-haven asset” suggesting wider uncertainty across the global market.”

About MarketVue Business Confidence

Quarterly findings are from Savanta’s MarketVue Business Confidence programme conducted among 2924 GB businesses from start-ups to companies with £1bn turnover, surveyed between 18th September 2025 – 12th December 2025.

Indices are mean scores based on a scale of ‘extremely positive’ (100), ‘fairly positive’ (75), ‘neither positive nor negative’ (50), ‘fairly negative’ (25) and ‘extremely negative’ (0), for the question “How do you feel about the current health of the UK economy?”

For more information contact us here.