Around one in five (18%) think it’s harder for them to change their lifestyle than for other people. That may not sound high, but regarding sustainable living, it’s the most well-intentioned segments who agree significantly more.

Examining broader lifestyle purchases, technology, furniture, clothing, personal care—it’s clear consumers’ prioritisation of convenience is a challenge. Most (76%) buy from a variety of retailers to meet their needs, with only 24% only going to brands they know to be ethical or committed to having a positive impact.

In our latest Sustainability Segmentation report we study how society is embracing – or resisting – a desire to meet sustainable goals, even during a deep and global economic crisis. We assess the often-complex attitudes consumers take towards sustainable lifestyle choices.

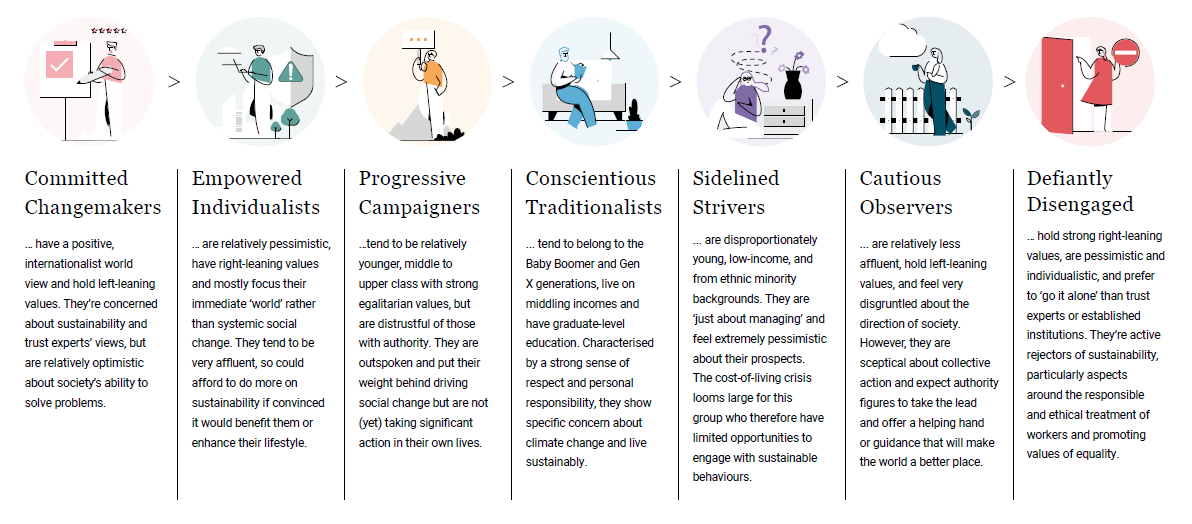

Our segmentation puts decision-makers on the front foot, helping marketers understand how to communicate and market sustainability in a manner that directly connects with customer values. Our findings show that in their intentions and actions towards sustainability, the public falls into seven segments; from Committed Changemakers who have a positive, internationalist world view and hold left-leaning values to the Defiantly Disengaged, those holding strong right-leaning values, who are pessimistic and individualistic and prefer to ‘go it alone’ than trust experts or established institutions.

Want to know more about your audience segments?

When it comes to lifestyle choice, there are signs of a sustainability-first mindset taking over.

Whereas sustainably produced food is the ‘premium’ choice, consumers can actually save money by behaving sustainably when it comes to other goods. Nearly half (43%) buy second hand where possible. Three quarters (75%) pass on unwanted items to others.

To discover what else is important to consumers overall when buying food, download our grocery infographic based on insights within our report here.

There has also been a noticeable backlash against ‘fast fashion’ in recent years. Our research reveals that the vast majority (77%) prefer to wear clothes for a long time and avoid buying new ones. It’s estimated that high-volume, low-price clothing sales could decline 10-30% in as soon as five years.[i]

The re-use mentality for clothing is something several typically less sustainably active segments have embraced better than others. The less affluent Cautious Observers (87%), the Defiantly Disengaged (82%) and Conscientious Traditionalists (81%) are among those most likely to avoid buying new clothes. Committed Changemakers and Empowered Individualists tend to do this too, but are more likely to feel it’s important to wear what’s in fashion right now.

Nevertheless, these segments are also the most likely to respond to marketing efforts around sustainability. Whereas 24% of the public only buy from brands committed to having a positive impact, this rises to 40% of Empowered Individualists and 39% of Committed Changemakers – plus 38% of Sidelined Strivers.

Download our infographic ‘How are consumers prioritising sustainable lifestyle choices’ here.

Overall, the majority (57%) still prefer to buy things new, but with a recession looming large many will also seek to extract more value out of what they already own.

So what?

- Cost is key, but so is convenience. Brands committed to having a positive impact must still aim to meet customers’ needs as broadly as possible, otherwise they will turn to other retailers.

- Consumers are embracing the principles of a ‘circular economy’ – keeping products in use for longer – which brands can support, for example by offering repair services.

- Savvy consumers can save money by spending less on long-term goods. Then, they can make money by selling what they no longer need, at fair prices, to others seeking good value. Brands could facilitate this by providing a specialist platform to connect buyers with sellers.

Notes:

The report is based on the findings of a survey of 12,016 adults aged 18+ in the United Kingdom (5,005), United States (5,006) and Canada (2,005). Data are weighted to be representative of age, gender, region and social grade (UK) or income/education (US and Canada).

Our segments include: