A first look at the impact of Coronavirus on the UK population

It’s started.

Last week we surveyed a nationally representative sample of 2,000 UK adults to capture the impact of Coronavirus on their attitudes and behaviours. Each week, for at least the next 8 weeks, we will bring you updates and help you understand how the national mood is changing and developing through the crisis.

Today we have some initial findings to share with you and an interesting visualisation on a link you can click on below.

25% of the population are the most worried they’ve ever been

What we asked and why we asked it

We asked the population 7 big questions:

1. How near do they feel to Coronavirus?

2. How worried are they?

3. What is the impact on their income?

4. What is the impact on their outgoings? (by category)

5. Who do they trust for information?

6. How long do people think the Coronavirus crisis will go on for?

7. How do people foresee life after Coronavirus?

We want to give brands, businesses, employers and the general public regular information about how the UK population is thinking and feeling during a time when we are increasingly being encouraged to isolate and disconnect.

Those motivated to receive the full dataset, or to ask their own questions, can do so by getting in touch here.

Key points:

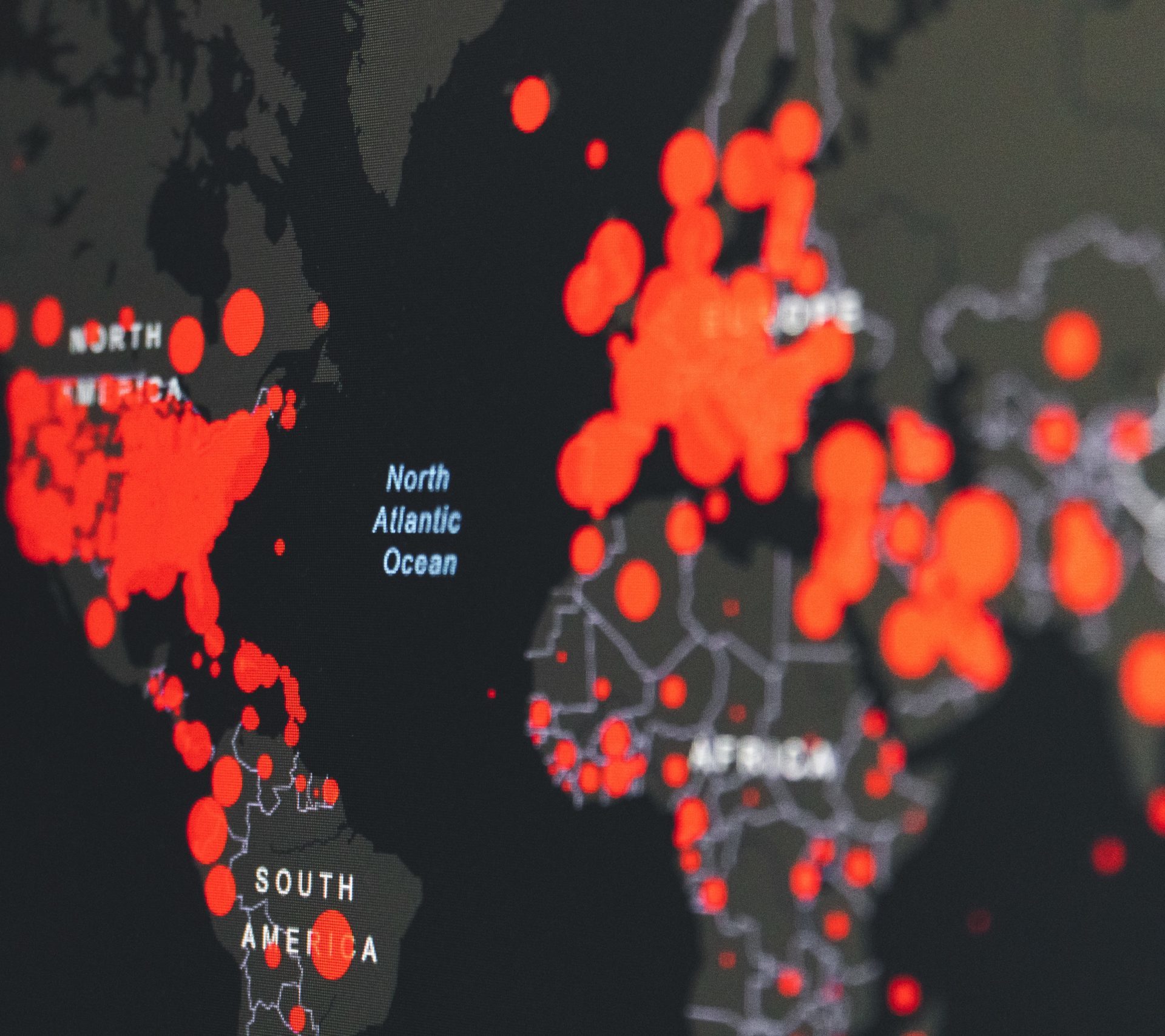

It’s clear that Coronavirus is a once in a generation crisis. The level of panic runs far ahead of the actual penetration of the virus into the population. People have looked at China, Italy and Europe and gained a frightening view of the approaching disruption and sadness.

Key stats:

• Everyone is aware of the situation

• 45% of people experiencing scarcity of goods in shops

• 18% of people have had an event cancelled

• 10% of people experiencing workplace disruption or being asked to work from home

• 6% claim to be self-isolating in one way or another

The result of all these experiences is a new form of mass anxiety. We asked people how worried they feel, on a scale of 1 – 5, where 1 is “Not worried at all” and 5 is “The most worried I’ve ever been”.

• 25% of the population are the most worried they’ve ever been

• Females are more worried than males, with 27% vs. 21% in the most worried category

• London and Northern Ireland have a significantly higher anxiety level, 28% and 38% respectively

Otherwise levels of anxiety are broadly constant across ages, regions, professions and social grades signalling the universal threat of the approaching virus.

We’ll see how this figure changes as people’s experiences change over time, especially with respect to infection levels and hospital capacity.

People’s economic outlook is darkening. Everyone is expecting a negative impact on their disposable income. The outlook in London is weakest with nearly half of all responders foreseeing less disposable income due to Coronavirus.

• 40% of people foresee their disposable income to fall

• 43% for ABC1 (more affluent) people and 35% for C2DE groups

• Pensioners and the unemployed feel least affected, but even they predict belt tightening ahead

Of course, all of this anxiety and weakening confidence results in disruption to spend in the economy. We are creating a detailed dataset about where, when and how this disruption is and will continue to manifest itself which we will talk about in the coming weeks and months. The key observation is that most categories will lose trade, but some will gain.

• Our initial data suggests out of home categories such as days out, out of home entertainment, eating out, holidays and gym have been and will continue to be most disrupted

• Least disrupted, but potentially positively impacted, are home improvement, alcohol for home consumption, gaming and streaming TV services

As the population becomes increasingly isolated, we will come to rely on remote sources of information to help us understand not only what is happening, but also what we, as individuals, businesses and communities, should do.

We asked people “Who do you trust for information about Coronavirus?” The answers were stark.

• Most trusted were healthcare professionals, yet only 60% of people actually trust what they say

• 59% now don’t trust the official government spokespeople (e.g. Chief Medical Officer)

• Yet even fewer trust their friends or family (14%) or social media (9%)

• 8% of people trust politician’s views on Coronavirus

Often, in national crises, we think brands have a powerful role in bringing people through. But, at this point in time, brands have gotten off to a very bad start.

• Only 1 in 25 people (4%) trust what brands and companies have to say about Coronavirus

• This is higher amongst more affluent ABC1 types (who are potentially more invested in these institutions)

• Interestingly, C2DE groups place more trust in local news than ABC1 people, offering an echo of Brexit going into the crisis

These results indicate both a profound level of scepticism and a frightening realisation that really, collectively we don’t know very much about Coronavirus. What is significant for brand owners is that, as it stands, they would do best not to communicate anything about Coronavirus if they want to maintain their pre-crisis trust ratings.

Over the next few weeks, we’ll dig deeper into the national psyche, covering topics such as:

• How the new home-bound workforce is coming to terms with working together, if alone

• What people see beyond Coronavirus

• The impact of changing spend habits across the economy, up and down the country

Certainly, this post has raised questions about the role of research in a time of crisis, just as much as it stimulates questions about how the population is dealing with the unfolding, unravelling reality of life in the UK during a pandemic.

Your comments and connections are welcome, if you would like to know more, to purchase more detailed data or analysis or would like to ask your own questions, click here.