Taxpayer concerns in 2025: Americans want reform & fear IRS delays

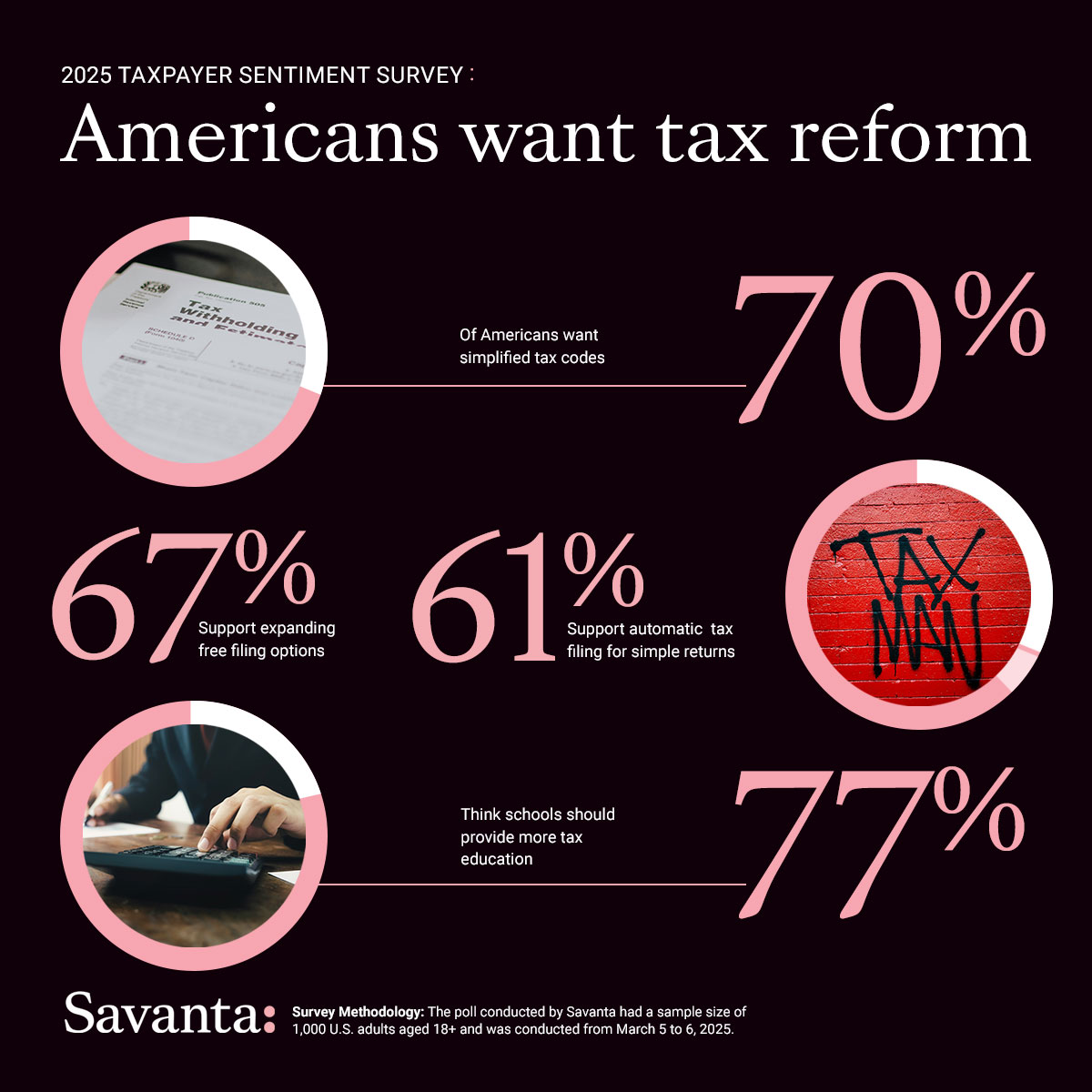

Tax season is here, and it’s bringing more frustration than ever for many Americans. According to our latest research, most taxpayers want a simpler, more accessible tax system, with 67% supporting expanded free filing options and 61% backing automatic tax filing for those with simple returns. At the same time, concerns about IRS staffing cuts are rising, with 38% of Americans expecting refund delays and 32% fearing more tax fraud due to a reduced IRS workforce.

It seems Americans are sending a clear message: the tax system is too complicated, and they want meaningful reform. With high levels of stress and confusion around tax filing and growing concerns over the Department of Government Efficiency (DOGE) IRS staffing cuts, this year’s tax season is shaping up to be particularly frustrating.

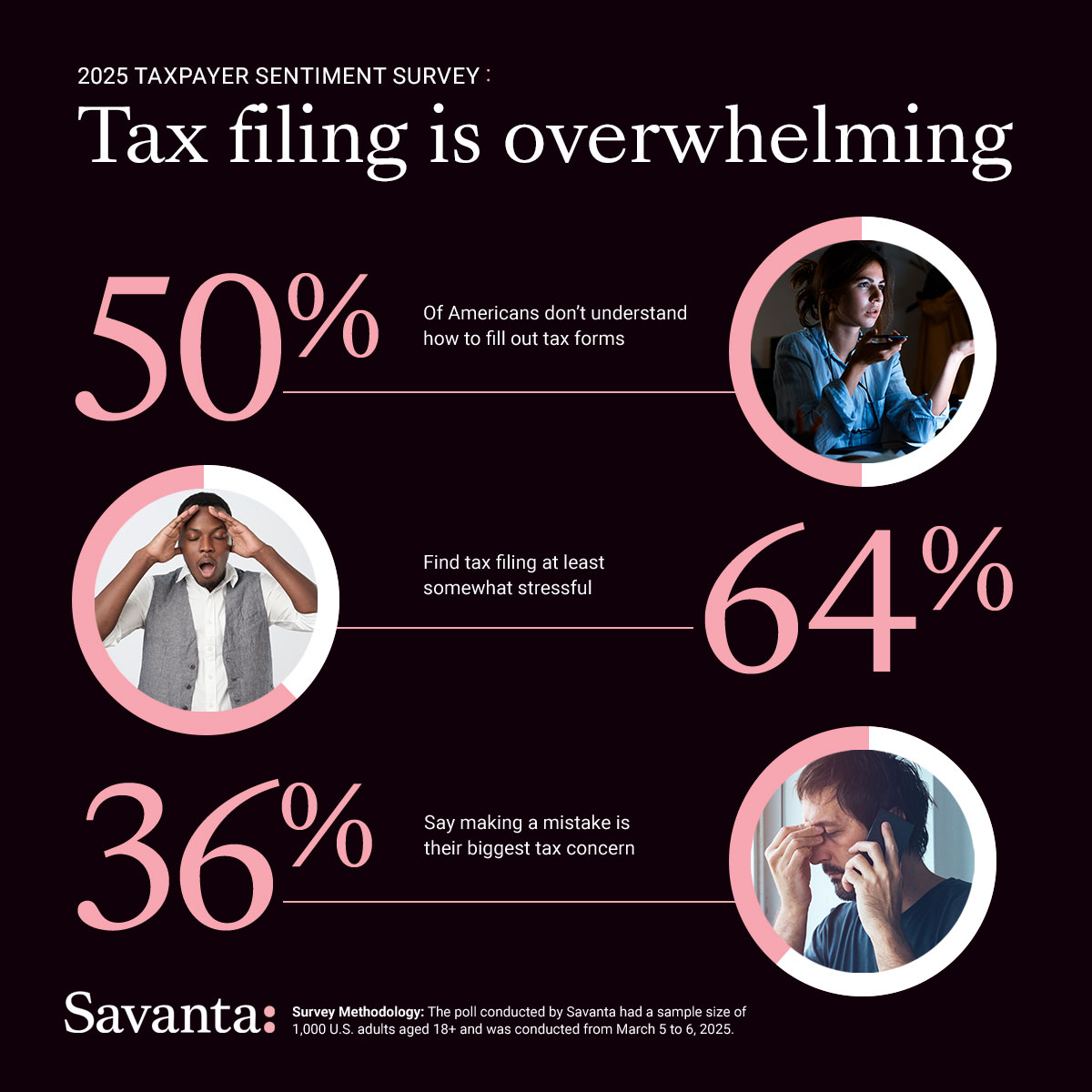

An overcomplicated system has Americans fed up

Tax season has long been a source of stress, but this year’s data highlights just how widespread the frustration is:

- Nearly 50% of Americans admit they don’t understand how to fill out their tax forms

- 64% find tax filing at least somewhat stressful

- 36% say making a mistake is their biggest tax concern

With so many struggling to navigate the system, it’s no surprise that Americans overwhelmingly support tax reform. 70% want a simplified tax code, and more than three-quarters (77%) believe schools should provide better education on taxes.

This isn’t just about convenience—it’s about fairness. Millions of Americans face unnecessary stress yearly because the system is too complex. Expanding free filing and simplifying the process could be game changers.

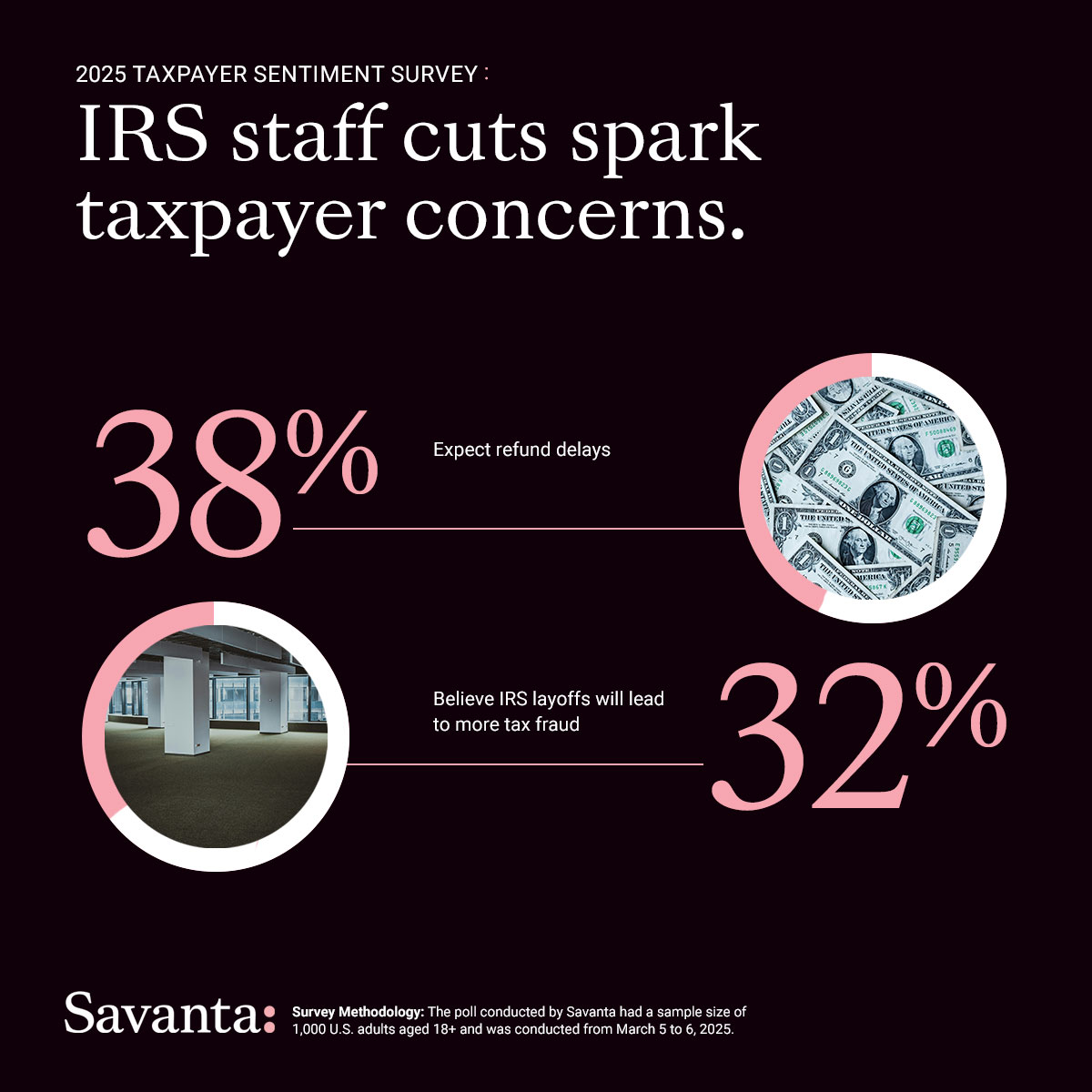

IRS staffing cuts fuel concerns over refund delays

On top of tax filing confusion, many Americans are worried about how IRS staffing changes will affect their refunds. According to our survey:

- 38% expect their refund to be delayed this year

- 32% believe fewer IRS staff members will lead to more tax fraud

Without enough staff to process filings efficiently, taxpayers could face longer wait times, processing errors, and reduced enforcement against fraud.

More Americans rely on tax professionals

Given the complexities of tax filing, it’s no surprise that many Americans turn to professionals for help. Nearly half trust national tax prep services or tax software to handle their returns, while AI-driven tax software still lags in trust at just 19%.

What’s next for taxpayers?

Americans are making it clear: they want a tax system that is easier to navigate, with better filing options and less red tape. Whether policymakers take action remains to be seen, but for now, millions of taxpayers are feeling the stress this season.

We can help with your next survey

We fielded this survey to a national audience of n=1000, and it was completed in approximately five hours. We have global access to consumers in over 95 countries to quickly field quantitative and qualitative surveys. We’d love to help with your next survey needs.