73% overall are meat eaters, and only one in ten (11%) rank reducing meat consumption as one of the top three actions for reducing an individual's carbon footprint.

As crises become increasingly immediate, sustainability is one culprit that gets pushed to the back of the agenda far too frequently. With war, economic challenges, and the ever-changing landscapes of industry sectors, behavioral shifts have become a constant.

But ultimately, the world’s many problems pale in comparison to the existential threat that climate change holds against our communities.

Savanta’s Sustainability Segmentation report studies how society is embracing – or resisting – a desire to meet sustainable goals, even during a deep and global economic crisis.

Want to know more about your audience segments… download our free report here.

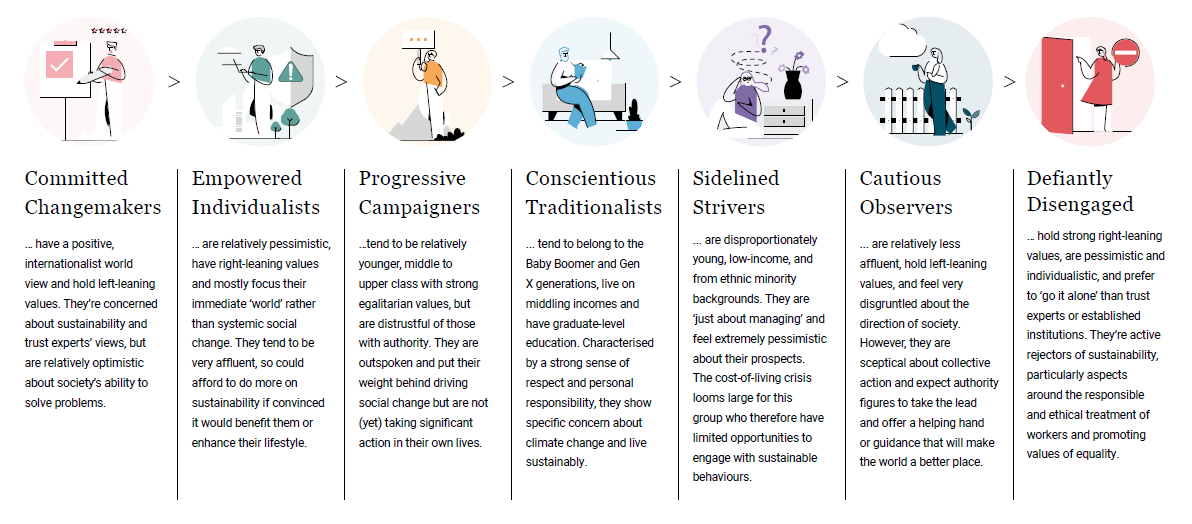

Our segmentation shows that in their intensions and actions towards sustainability, the public falls into seven segments; from Committed Changemakers who have a positive, internationalist world view and holds left-leaning values to the Defiantly Disengaged, those holding strong right-leaning values, who are pessimistic and individualistic and prefer to ‘go it alone’ than trust experts or established institutions.

Grocery and food companies have made concerted efforts to produce products through a green lens, with steps towards reducing food waste, eating local, sustainable food packaging, and more. But where does this sit as a priority for individuals looking to cut costs? The report breaks down consumer behaviors across sectors to determine where sustainable practices shift from intention to action.

Download our infographic on sustainability surrounding the grocery and food sector here.

As the cost-of-living crisis escalates, many consumers face extreme trade-offs. Some skip meals to keep the lights on – while others choose between food, fuel, rent, medical care, and more.

Even for those with less extreme choices to make, there’s still a greater risk they’ll de-prioritize efforts to live more sustainably right now.

Therefore, it’s unsurprising that value for money (62%) is the top consideration for food shopping. Also key are ingredient quality (55%)—showing there are still some things consumers refuse to compromise on—and low prices (52%).

Regarding diet, meat isn’t leaving the menu anytime soon; 73% overall are meat eaters, and only one in ten (11%) rank reducing meat consumption as one of the top three actions for reducing an individual’s carbon footprint. Yet Western countries must cut meat consumption by three-quarters to meet climate change goals.

Flexitarians account for 17% overall, followed by vegetarians (5%) and vegans (3%). Committed Changemakers lead the way: 33% are flexitarians, 13% are vegetarian, and 12% are vegan. Only 40% are meat eaters. Empowered Individualists are also much more likely to have moved away from meat—only 52% eat it, and 27% are flexitarians.

But the Western Pattern Diet (WPD) is popular for a reason. For many, pre-packaged meat is cheap, filling, quick to cook, and tasty, perhaps why 70% of the eco-conscious Progressive Campaigners remain meat eaters, as do the relatively older Conscientious Traditionalists (79%) and Cautious Observers (81%) who grew up on traditional diets.

However, there’s an interesting difference among lower-income segments. While 87% of the Defiantly Disengaged eat meat, Sidelined Strivers (60%) are well below average. Sidelined Strivers are above average on other diets, such as veganism, vegetarianism, and flexitarianism— proven by research to be the most affordable. Their primary intention may have been just to keep food costs down—but in doing so, they are also eating more sustainably.

Apart from value, quality, and price, what else is important to consumers overall? Find out more in our latest Sustainability Segmentation Report.

Notes:

The report is based on the findings of a survey of 12,016 adults aged 18+ in the United Kingdom (5,005), United States (5,006) and Canada (2,005). Data are weighted to be representative of age, gender, region and social grade (UK) or income/education (US and Canada).