Our research reveals that the vast majority (77%) prefer to wear clothes for a long time and avoid buying new ones.

As crises become more and more immediate, sustainability is the culprit that gets pushed to the back of the agenda more and more frequently. With war, economic challenges, and the ever-changing landscapes of industry sectors, behavioral shifts have become a constant.

But ultimately, the world’s many problems pale compared to the existential threat that climate change holds against our communities.

Savanta’s 2022 Eco Segmentation studies how society is embracing, or resisting, a desire to meet sustainable goals, even during a deep and global economic crisis. For businesses to understand what choices consumers make and where they fall complacent for the sustainable alternative, they must first understand what values consumers hold dear and what intrinsic behaviors they possess.

Want to know more about your audience segments… download our free report here.

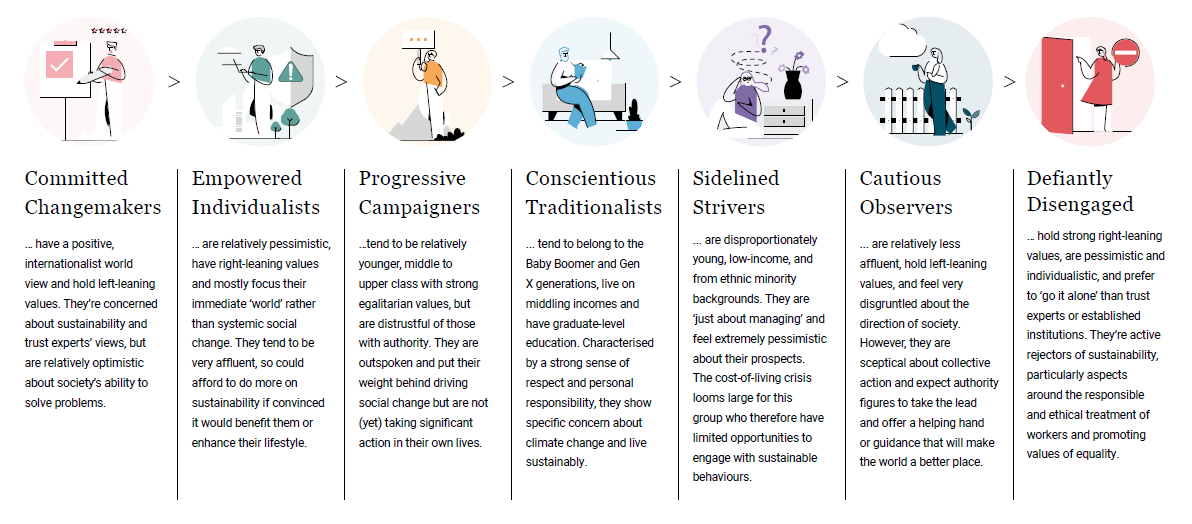

Our segmentation shows that in their intensions and actions towards sustainability, the public falls into seven segments; from Committed Changemakers who have a positive, internationalist world view and holds left-leaning values to the Defiantly Disengaged, those holding strong right-leaning values, who are pessimistic and individualistic and prefer to ‘go it alone’ than trust experts or established institutions.

The report breaks down consumer behaviors across sectors to determine where sustainable practices shift from intention to action. Lifestyle brands have been making serious waves in the industry for sustainable initiatives, reimagining what it means to sustainably live.

Examining broader ‘lifestyle’ purchases—technology, furniture, clothing, personal care—it’s clear consumers’ prioritization of convenience is a challenge.

Download our infographic on sustainability surrounding the lifestyle sector here.

Value for money (64%) and product quality (57%) are the top criteria for lifestyle purchases. Again, aside from cruelty-free, sustainability certifications are not high priority factors (and have previously been found to raise concerns about compromised product quality).

Around one in five (18%) think it’s harder for them to change their lifestyle than for other people. That may not sound high, but regarding sustainable living, it’s the most well-intentioned segments who agree significantly more— Empowered Individualists (42%) and Committed Changemakers (29%). Only 11% and 25% respectively disagree.

The result? Most (76%) buy from a variety of retailers to meet their needs, with only 24% solely going to those they see as ethical or committed to having a positive impact. This is still a minority mindset even among Empowered Individualists (39%) and Committed Changemakers (40%), showing that efforts to market based on sustainability credentials alone are likely to fall flat.

However, there are signs of a sustainability-first mindset taking root. Whereas sustainably produced food is the ‘premium’ choice, consumers can actually save money by behaving sustainably when it comes to other goods. Nearly half (43%) buy second-hand where possible and 75% pass on unwanted items to others.

The drive towards second-hand and resale has been particularly noticeable in the fashion sector, with platforms such as Vinted and Depop allowing consumers to get their ‘fast fashion’ fix sustainably and— crucially—cheaply. Now our research reveals that the vast majority (77%) prefer to wear clothes for a long time and avoid buying new ones. It’s estimated that high-volume, low-price clothing sales could decline 10-30% in as soon as five years.

The re-use mentality for clothing is something several typically less sustainably active segments have embraced better than others. The less affluent Cautious Observers (87%), the Defiantly Disengaged (82%) and Conscientious Traditionalists (81%) are among those most likely to avoid buying new clothes. Committed Changemakers and Empowered Individualists tend to do this too but are more likely to feel it’s important to wear what’s in fashion right now. It’s significantly more important to 18-24s too.

Overall, the majority (57%) still prefer to buy things new, but with a recession looming large many will also seek to extract more value out of what they already own.

To find out more about how sustainability plays into consumers purchasing decisions and actions, download the full report: Sustainability Segmentation Report. Sectors in the report span from travel and transport, to home and energy, to insights exploring Gen Z and the nations Youth.

Notes

The report is based on the findings of a survey of 12,016 adults aged 18+ in the United Kingdom (5,005), United States (5,006) and Canada (2,005). Data are weighted to be representative of age, gender, region and social grade (UK) or income/education (US and Canada).