46% of liberal but lower-income Progressive Campaigners say renewable energy is an important factor in their decisions, yet only 22% have chosen such a tariff.

The ongoing energy crisis has heavily restricted competition for home utilities. Cost is top of mind for all segments, but the events of 2022 have for the first time made visible to consumers the link between renewables, energy security, and lower prices in the long-term.

About the study

In our latest Sustainability Segmentation report we study how society is embracing – or resisting – a desire to meet sustainable goals, even during a deep and global economic crisis. Within this article we focus-in on the home and energy sector, assessing the paradoxical behaviour between intentions and actions across our identified segments.

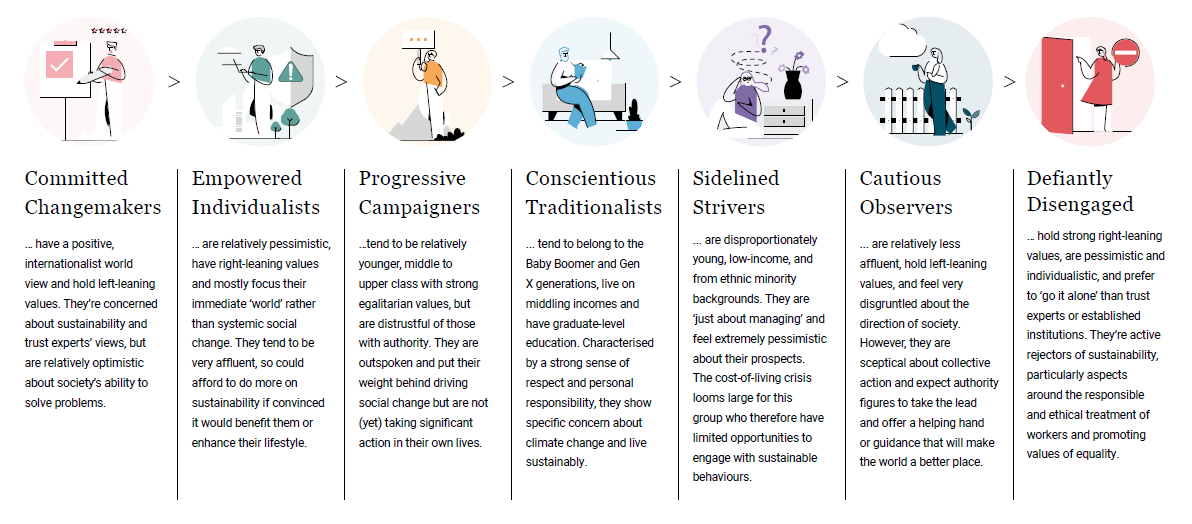

Our segmentation puts decision-makers on the front foot, helping marketers understand how to communicate and market sustainability in a manner that directly connects with customer values. Our findings identified that the public falls into seven segments; from Committed Changemakers who have a positive, internationalist world view and hold left-leaning values to the Defiantly Disengaged, those holding strong right-leaning values, who are pessimistic and individualistic and prefer to ‘go it alone’ than trust experts or established institutions.

Want to know more about your audience segments?

Download our free report here.

Priorities when selecting an energy provider

When it comes to choosing an energy provider consumers are facing a dilemma. Whilst many desire to choose a ‘green’ tariff, currently only the most affluent segments feel they are able to prioritise renewable energy. The majority of Committed Changemakers and Empowered Individualists say renewable energy is an important criteria when selecting their energy supplier and over half will act on this; whereas 46% of the liberal but lower-income Progressive Campaigners say renewable energy is an important factor in their decisions, but only 22% have chosen such a tariff.

Only one in five (18%) of the Defiantly Disengaged say renewable energy is an important factor and similarly only 15% of Sidelined Strivers say the same. How can the industry and governing bodies make renewable energy more affordable and attractive to these segments? Our full report explores case examples of innovators working towards this goal.

To discover the extend to which consumer intentions and actions vary across our segments, download our infographic here.

Small changes and big savings

There are other ways consumers can cut-back, regardless of tariff type or cost. Our study revealed that 62% of consumers are trying to reduce how much water they use and 60% have already installed energy-efficient light bulbs in their homes. This energy-saving behaviour appears to be driven by cost-saving goals rather than a wider sustainable mission, but either way, these quick wins offer a mutual solution that bridges the economic disparities across the segments.

And there’s plenty more that can be done that will be better for the wallets as well as the planet. Our full report identifies an opportunity for suppliers to offer guidance and raise awareness on how small changes can lead to big rewards.

Download our infographic to reveal consumer interest in installing solar panels.

So what?

- Cost is key, but so is service. Customer service is the clear second criteria that consumers look at when choosing an energy provider, pin-pointing the importance of keeping customers informed and explaining implications behind developments.

- Suppliers can compete for customer loyalty by educating customers on how to reduce energy waste more effectively, without making any major lifestyle changes – Smart Meters present an opportunity to reengage customers with energy and provide real-world feedback on their behaviour.

- There’s an opportunity for home product ranges to communicate their energy saving credentials – e.g. air fryers, electric blankets.

Notes:

The report is based on the findings of a survey of 12,016 adults aged 18+ in the United Kingdom (5,005), United States (5,006) and Canada (2,005). Data are weighted to be representative of age, gender, region and social grade (UK) or income/education (US and Canada).

Our segments include:

Download the full report: